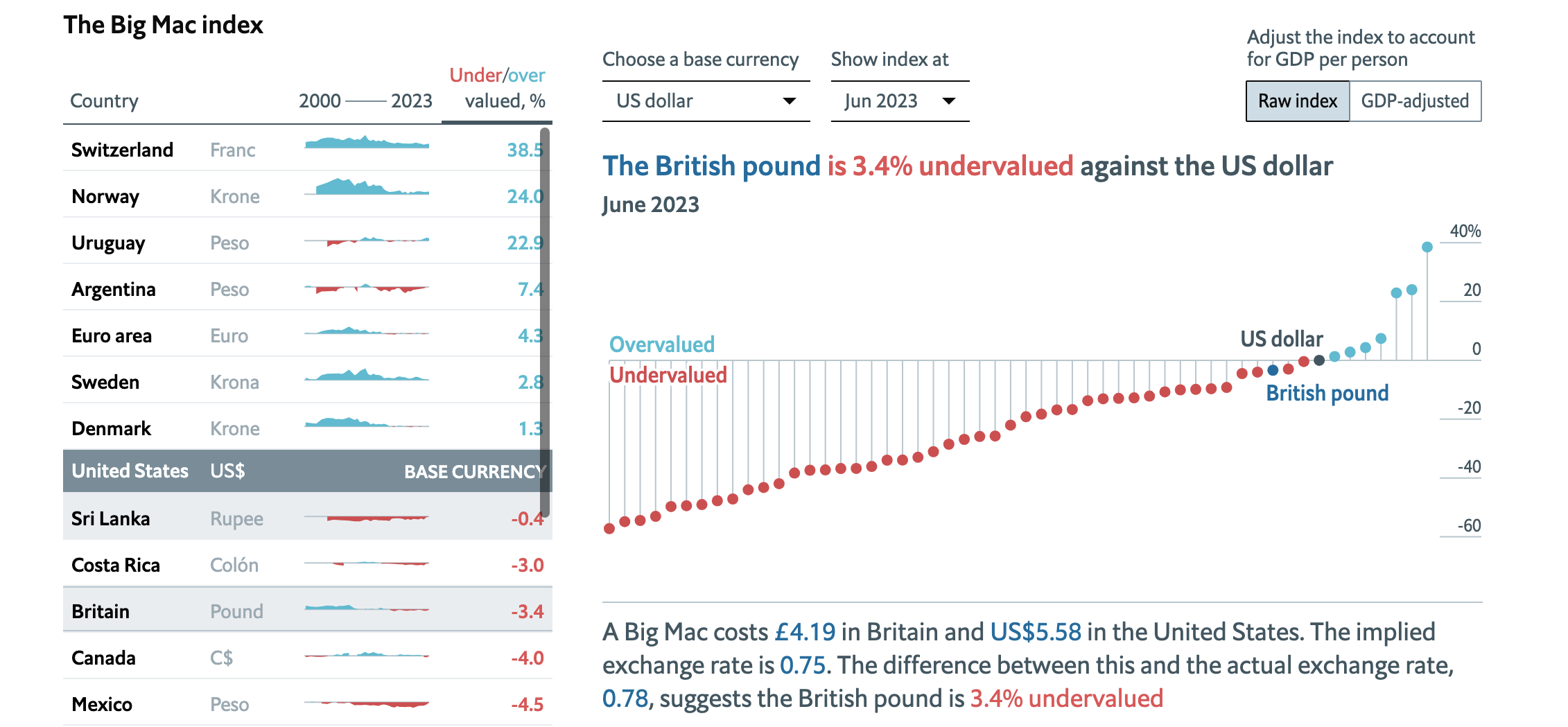

The Big Mac Index: Exploring Currency Valuation and Inflation

The Big Mac Index is an intriguing economic indicator that offers a unique perspective on the world’s currencies and purchasing power parity (PPP). Created by The Economist in 1986, it has since gained significant recognition as a tool for illustrating currency value comparisons.

What is the Big Mac Index?

Taking a common product available in numerous countries—the McDonald’s Big Mac—the index compares its prices across different currencies. This provides insight into whether a currency is overvalued or undervalued in relation to the US Dollar.

Understanding Purchasing Power Parity (PPP)

The theory underlying the Big Mac Index is purchasing power parity (PPP). According to PPP, identical goods should have the same price in different countries, assuming no transaction costs or trade barriers, when expressed in a common currency.

Sources: The Economist, McDonald’s; Refinitiv Datastream;

IMF; Eurostat; LebaneseLira.org; Banque du Liban;

The EconomistNote: All prices include tax

The idea is that if a currency is overvalued, local goods will seem more expensive to foreigners, and foreign goods will appear cheaper to locals. Conversely, an undervalued currency will make local goods seem cheaper to foreigners and foreign goods more expensive to locals.

How it Relates to Inflation

While the Big Mac Index does not directly measure inflation, it can indirectly provide insights into inflationary pressures. If the price of a Big Mac rises more quickly in one country compared to others, it may indicate a higher local inflation rate.

This shift in the Big Mac Index can serve as an indicator that the currency might be overvalued.

Unveiling the Unique Perspective of The Big Mac Index

The Big Mac Index offers a captivating and informal lens through which to view currency valuation and inflation trends. Its analysis of relative currency values provides valuable information for economic considerations and global financial insights.

Limitations:

While the Big Mac Index is a simplified measure, it is not without limitations. Factors that can affect its accuracy include:

Taxes and Import Duties: Varying taxation policies across countries can impact the retail price of a Big Mac.

Cost of Living and Labor Costs: These factors differ significantly between countries and can influence the final price.

Local Preferences and Competition: McDonald’s may adjust the Big Mac price differently based on competitive pressures or consumer preferences in certain regions.

Using the Big Mac Index:

Despite its simplicity, the Big Mac Index serves as a powerful tool for visualizing the complex concept of Purchasing Power Parity (PPP). It is instrumental in:

Gauging Relative Currency Valuation: Economists and investors rely on the Big Mac Index to assess the relative valuation of currencies and identify potential mismatches between market exchange rates and PPP.

Enhancing Learning: The index is an effective teaching tool, providing accessibility in explaining concepts like exchange rates and PPP.

The Big Mac Index is a novel and engaging economic indicator that offers insights into currency valuation based on the theory of PPP. While it does not directly measure inflation, its intuitive nature makes it a valuable resource for understanding fundamental economic concepts.

However, it is crucial to consider its limitations and underlying assumptions. The index should be used as a supplementary tool or for educational purposes rather than as the sole basis for economic decision-making.