Investment Research from John Rothe, CMT

Why the S&P 500 Feels Stuck—and What to Watch Next

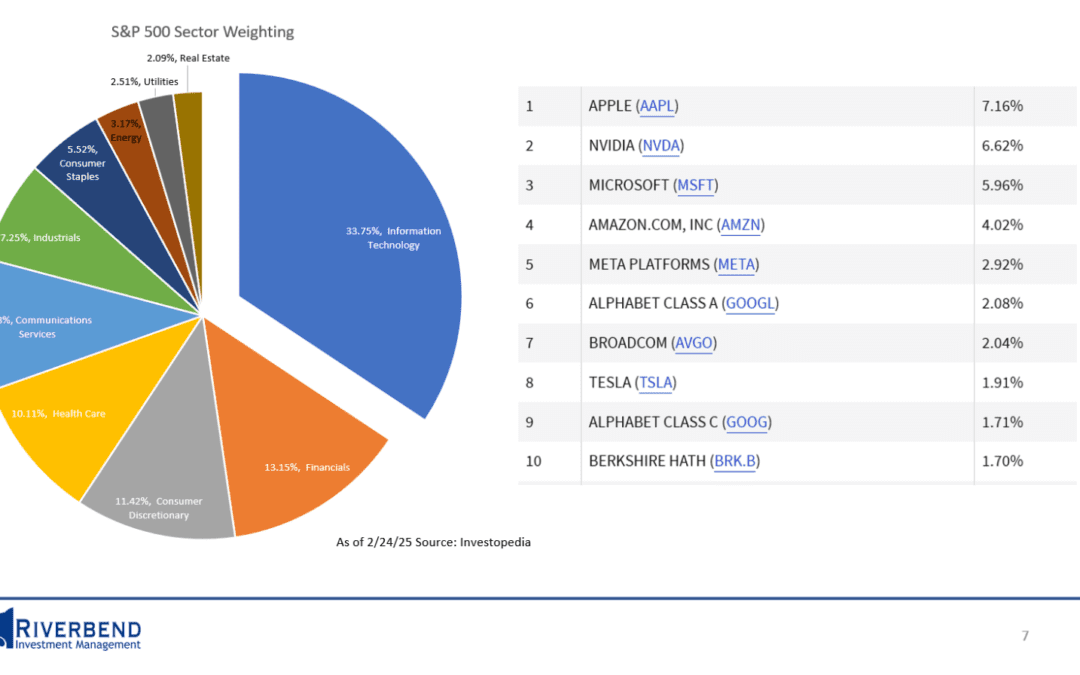

If you’ve felt like the S&P 500 is “stuck” despite constant bullish headlines, it’s worth looking at what the index is actually made of—and what’s driving it right now. Because tech is such a large portion of the S&P 500’s weight, when mega-cap tech cools off or chops sideways, it can quietly stall the entire index even if many other stocks are doing fine…

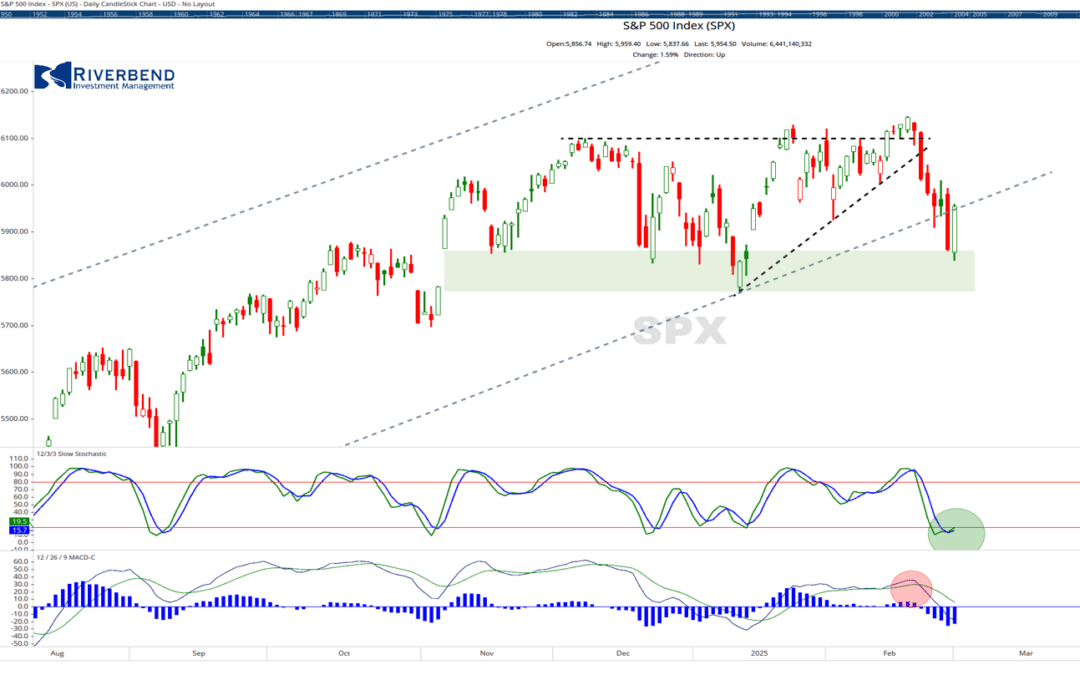

Further Crash or Is It Time to Buy?

Global stock markets aggressively sold off on the news that US tariffs would be more significant than expected. Will the market continue to decline, or is the selling overdone? This week, I discuss key levels to watch, what...

Stock Market Crash Ahead?

The US stock market continues to decline, with investors starting to worry that rising inflation combined with slower economic growth may lead to a stock market crash. This week, I discuss the key levels I am watching and where I...

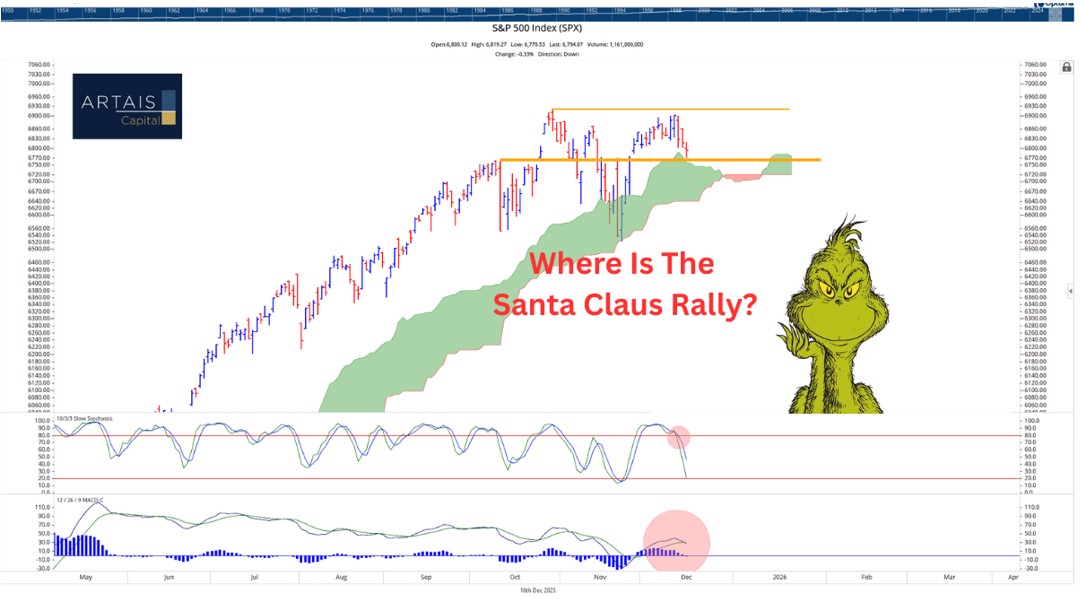

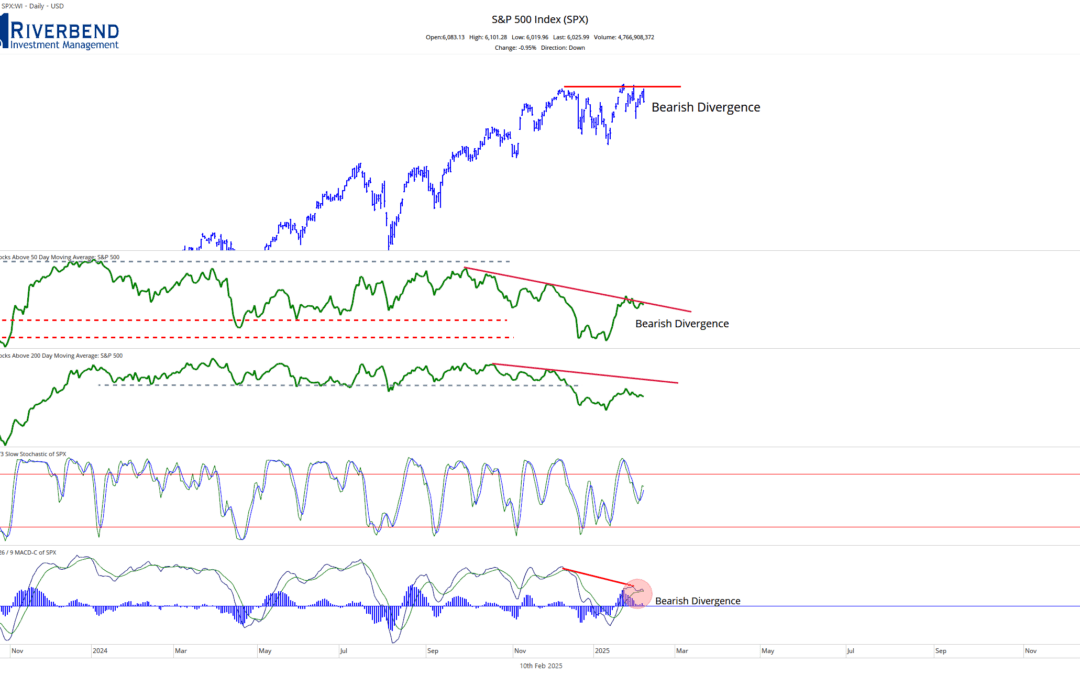

Seasonal Trend or Start of a Structural Breakdown in the Stock Market?

Historically, February is a weak month for stocks in the year following a presidential election. Was the recent weakness just seasonal, or is the market about to start structurally breaking down? In this week's video, I discuss the charts I am watching to help...

Is It Risk On Time for Tech and AI Stocks?

Since the US Presidential election, the S&P 500 has been range-bound, as investors digest the news of tariffs, inflation, and what the Fed may do next.

However, Tech and AI stocks may be in the beginning innings of a move higher, potentially setting up for a breakout of the S&P 500 to new all-time highs.

Inflation Is Starting to Rise Again – Here are the Charts I am Watching

Inflation is on the rise again. Here are the charts I am watching and where some of the opportunies are.

When Will The Sideways Trading Range End?

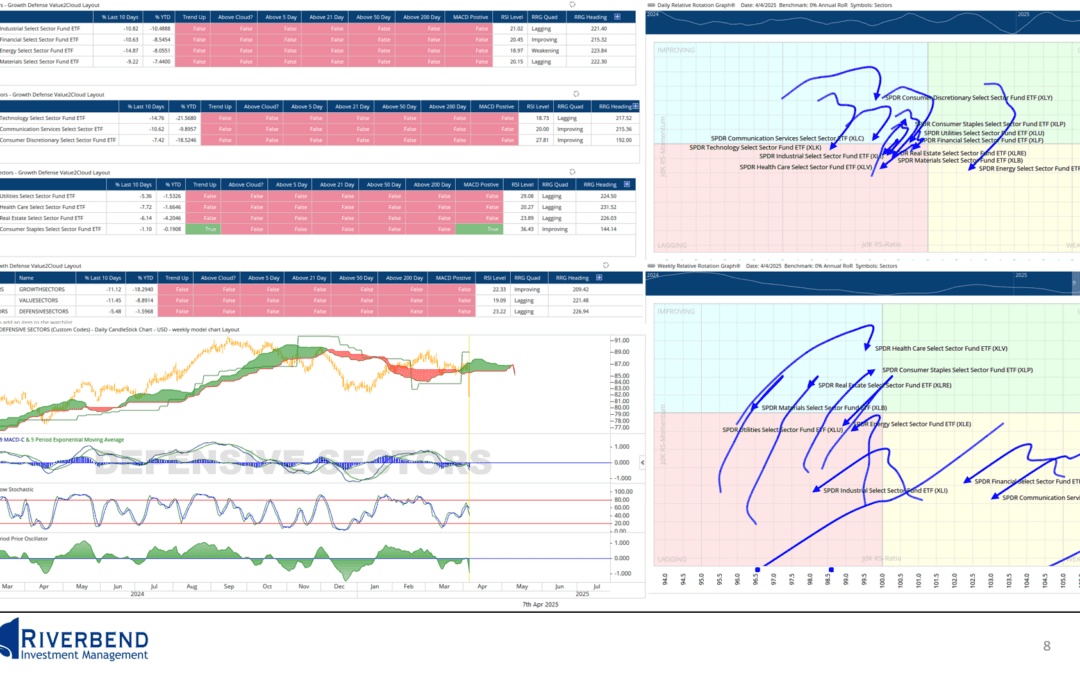

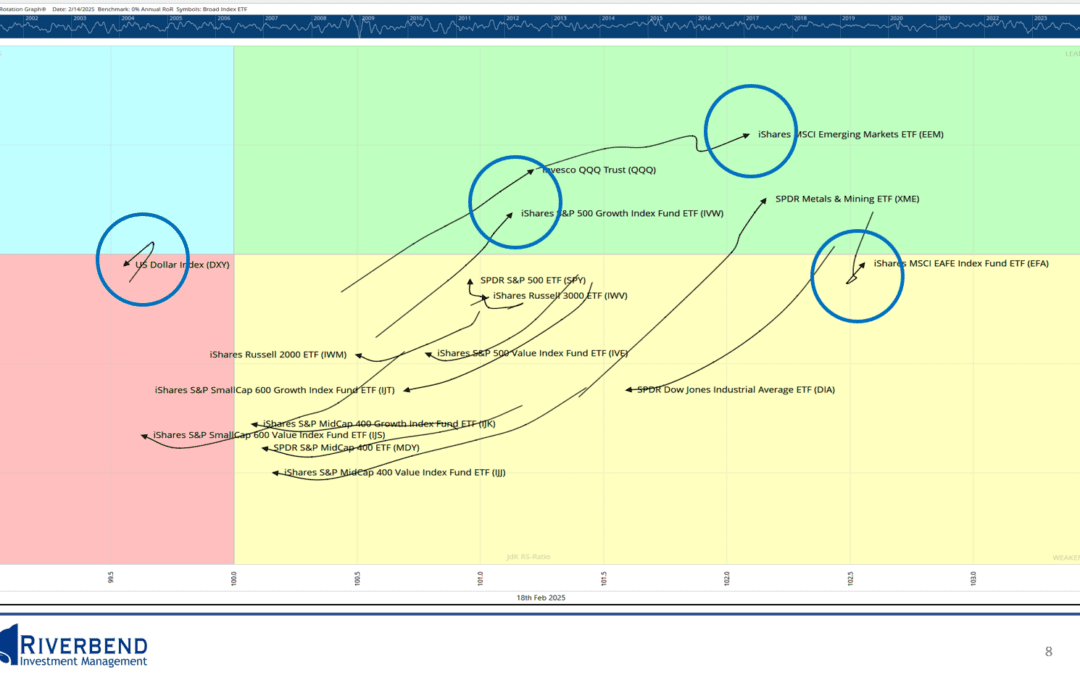

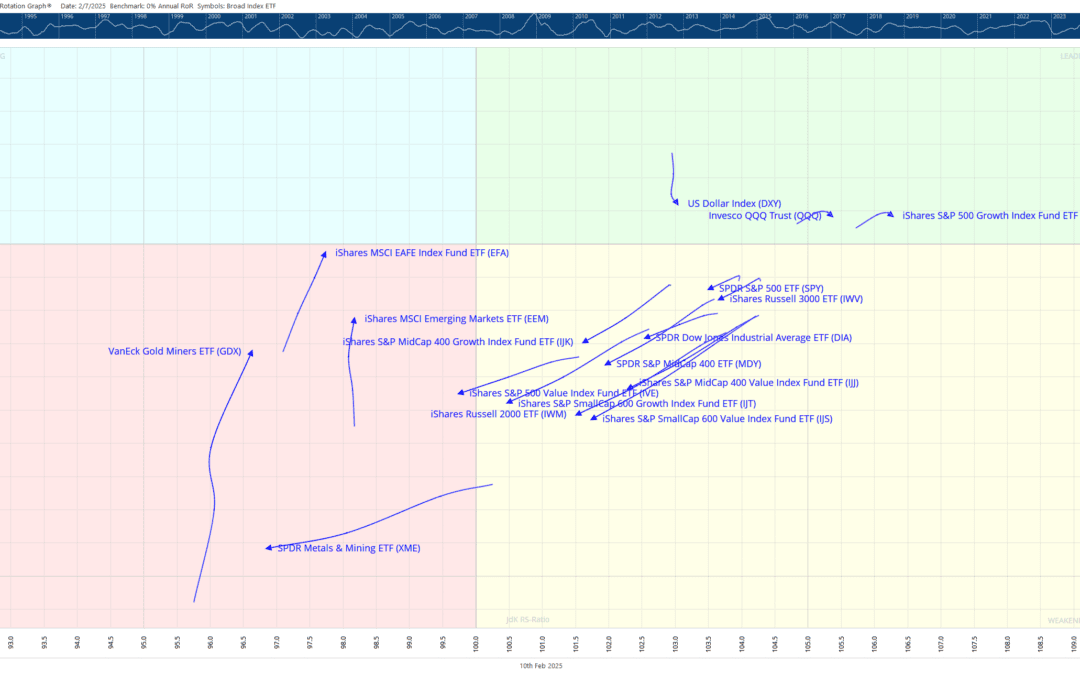

One of my favorite tools, which I use daily, is Relative Rotation Graphs (RRG). They allow us to view the rotation of the stock market and allows us to see which areas have increasing momentum and rising relative strength.

Behavioral Finance: Understanding the Psychology Behind Investment Decisions

Behavioral finance is the study of how psychological factors affect financial decisions and, by extension, financial markets. It seeks to explain why individuals often make irrational financial choices that deviate from what traditional economic theories would predict. The field challenges the notion that markets are always efficient and that investors always act rationally to maximize their wealth.

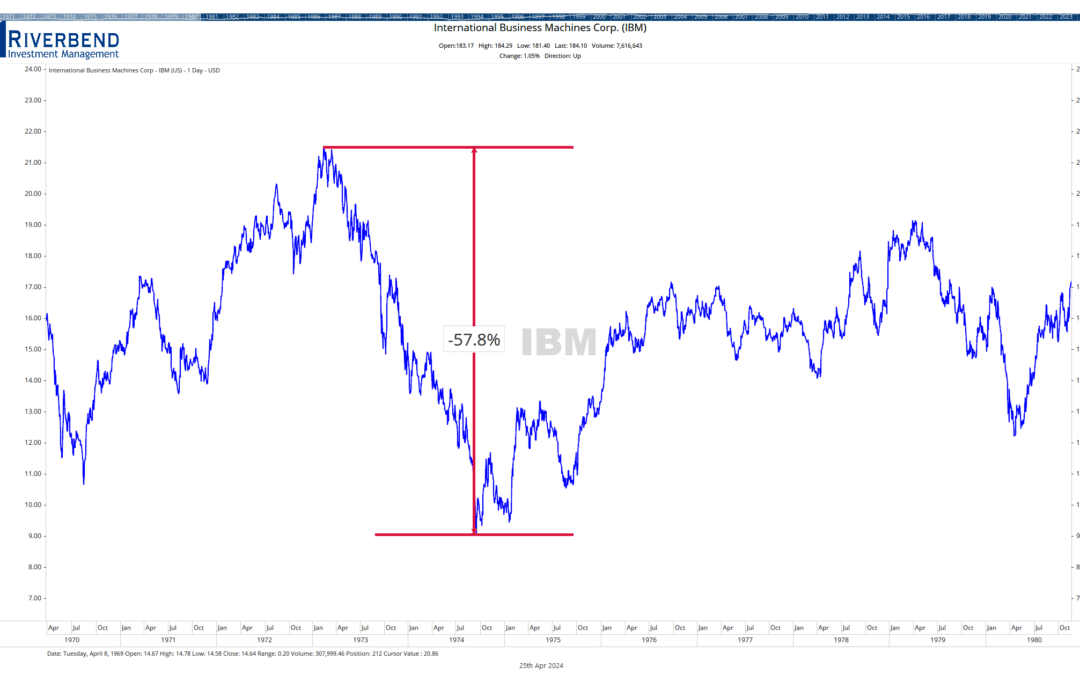

Looking back at the 1970’s: Which Areas of the Stock Market Did Well Under Stagflation

What is Stagflation? Stagflation refers to the rare combination of high inflation, slow economic growth, and high unemployment. In a typical business cycle, inflation rises during periods of strong growth and falls during recessions when unemployment spikes. But in...

Using Volatility to Manage Risk in the Stock Market

Understanding and managing volatility is essential to minimize risk and optimize portfolios. Volatility, as measured by the VIX (Volatility Index), can provide insights into market sentiment. Changes in volatility can serve as warning signs for potential trend reversals in individual stocks as well.