The stock market had a strong start to 2023, with the S&P 500 finishing January with nearly a 6% gain. However, that trend began to reverse, as investors started to weigh the impact of numerous economic changes and challenges – such as mixed inflation data, bank failures, and a continued shortage of workers.

Below is a summary of potential headwinds facing investors during the second quarter of 2023.

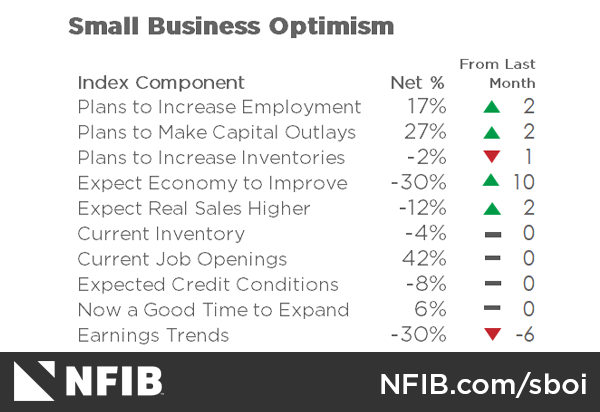

U.S. Sector Performance Reverses During 1Q 2023

The start of 2023 has been an intriguing one for the stock market. Generally, the sectors that performed poorly in 2022 are performing well in 2023, while the top-performing sectors in 2022 are underperforming in 2023.

Notably, there has been a remarkable performance turnaround in Growth-style sectors, which includes Technology, Communication Services, and Consumer Discretionary.

These sectors went from being the worst-performing sectors in 2022 to the top three-performing sectors in the first quarter of 2023. This market rotation should be noted since it could signify a shift in investor psychology, as they redirect investments toward underperforming asset classes, potentially indicating a boost in investor confidence.

There could be various catalysts that explain this reversal of fortune. Firstly, growth sectors suffered in 2022 due to the Federal Reserve’s interest rate hikes, which weighed down expensive growth stock valuations.

Secondly, growth stocks are usually businesses with more robust fundamentals, which could explain why investors capitalized on their oversold nature and stronger fundamentals to shift towards higher quality companies, especially after concerns about the U.S. financial system’s stability following bank failures. Market observers will be keeping a close eye on the situation.

Source: MarketDesk

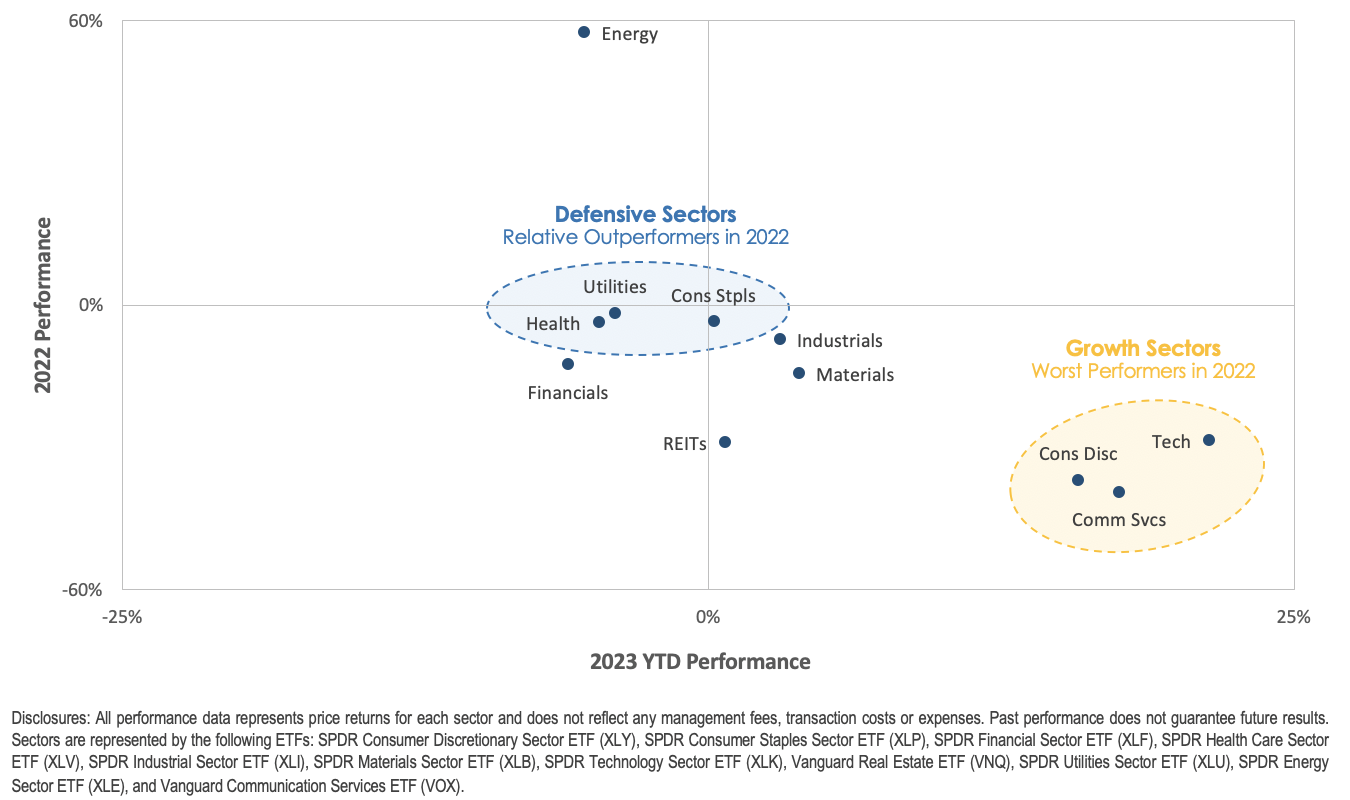

S&P 500’s Valuation Multiple – Overvalued or Undervalued?

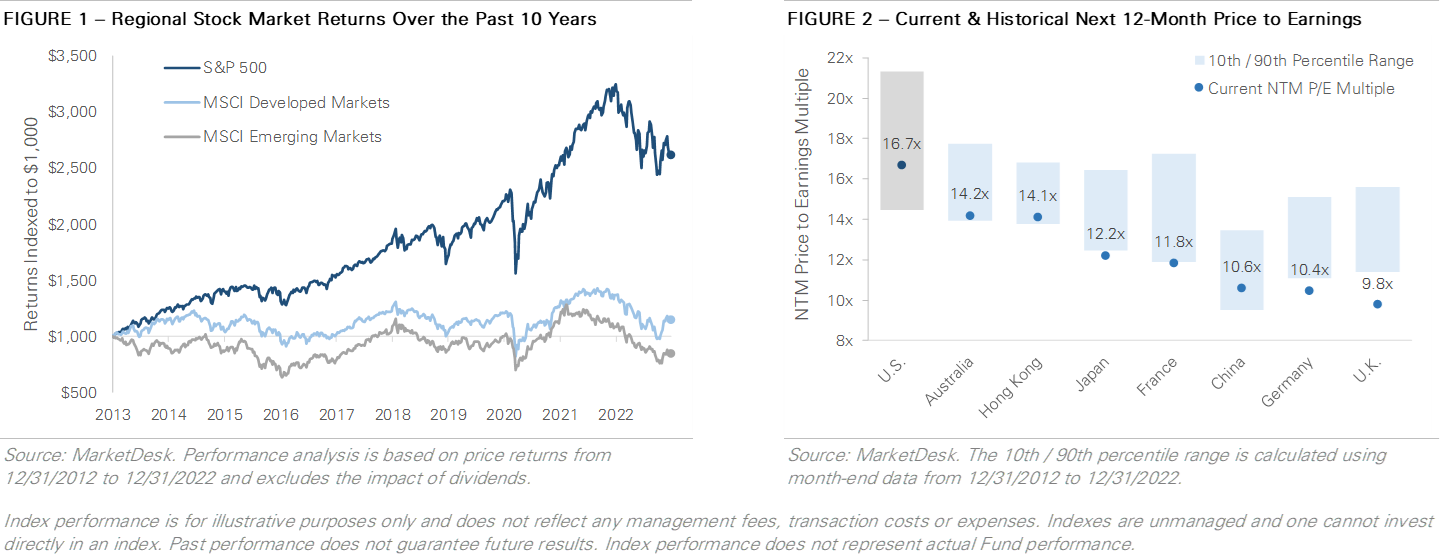

At the start of the pandemic, the S&P 500’s earning multiple surged after the Federal Reserve cut interest rates to 0%, and for the most part of 2021, it remained stable to slightly lower as corporate earnings recovered, and the S&P 500 grew into its valuation. However, the earning multiple took a nosedive in 2022 as the Federal Reserve raised interest rates aggressively, which had an impact on expensive Growth stock valuations.

With the constant stream of news and economic data, it’s easy to forget what you’re investing in.

As of the end of the first quarter, the S&P 500 is trading at approximately 18x its next-12 month earnings, compared to the average of 16x since 2000.

The data indicates that investors are paying a premium over the long-term average, but current multiples are within the range from 2015-2020.

The upcoming earnings season, starting in mid-April will be the next test for the S&P 500 and give investors a better idea of the impact higher rates are having on earnings.

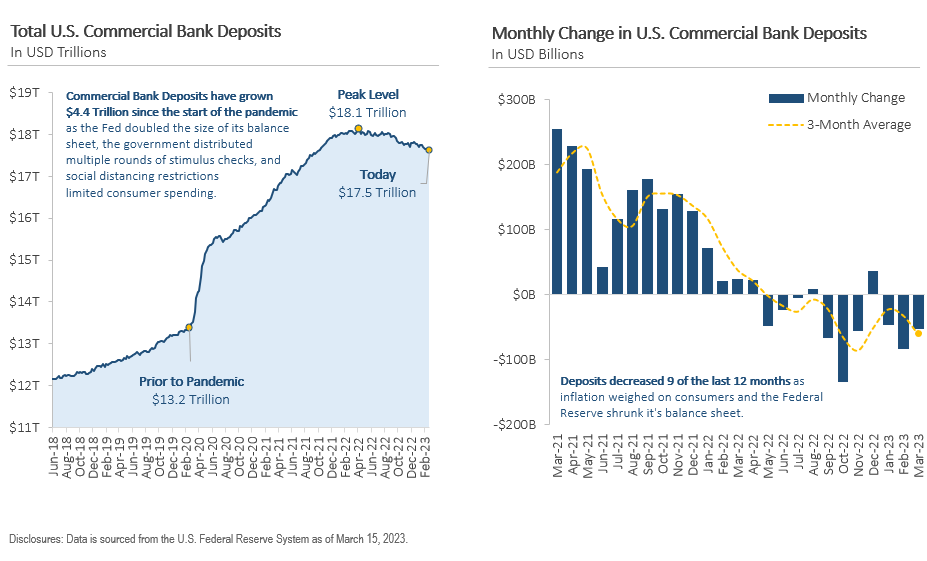

A Simple Explanation of Recent Bank Failures

The banking industry is currently experiencing a crisis of confidence as depositors withdraw their checking deposits in search of higher yields. Deposits at U.S. commercial banks rose significantly from $13.2 trillion at the end of 2019 to a peak of $18.1 trillion in April 2022, as individuals and businesses flocked to banks during the pandemic. However, deposits have decreased in 9 of the last 12 months, placing pressure on some banks’ balance sheets.

Recently, three banks faced an overwhelming number of withdrawal requests in early March.

In order to fulfill these requests, they sold portions of their bond portfolios, including government bonds and mortgage-backed securities. However, interest rates are now significantly higher than when the banks originally purchased these bonds, resulting in significant losses when they were sold.

These losses have drained the banks’ capital cushions and left them technically insolvent. Fortunately, state banking regulators and the FDIC stepped in to take over the failed banks and protect depositors.

While recent bank failures have raised concerns about financial stability and drawn comparisons to the 2008 financial crisis, there are significant differences between the two events.

Regulatory changes since 2008 have strengthened the overall financial system, with higher capital requirements providing banks with a more robust financial cushion. Additionally, the cause of the recent bank failures was rapid interest rate increases by the Federal Reserve, which resulted in paper losses for banks. In the weeks following, the Federal Reserve implemented new lending programs to prevent a wider banking crisis. Markets will be closely monitored for signs of contagion in the coming months.

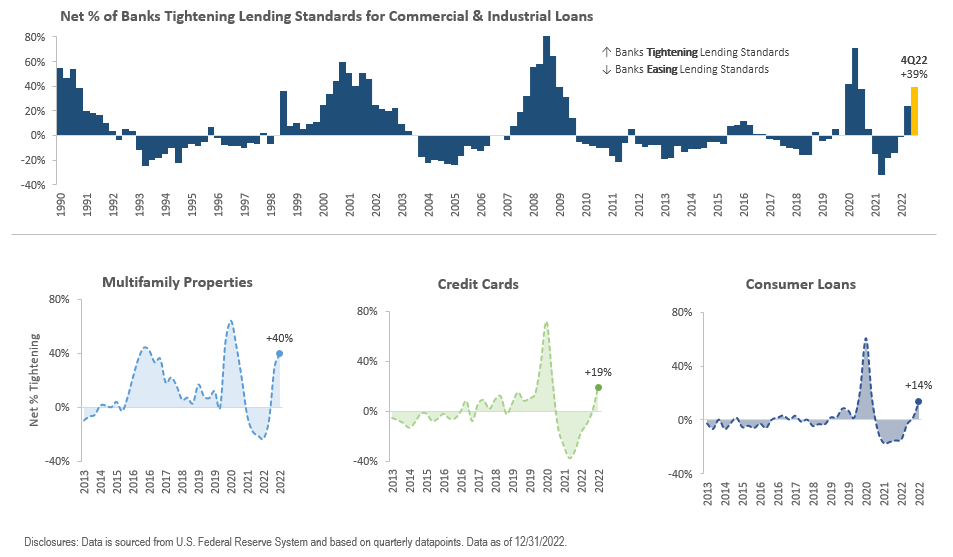

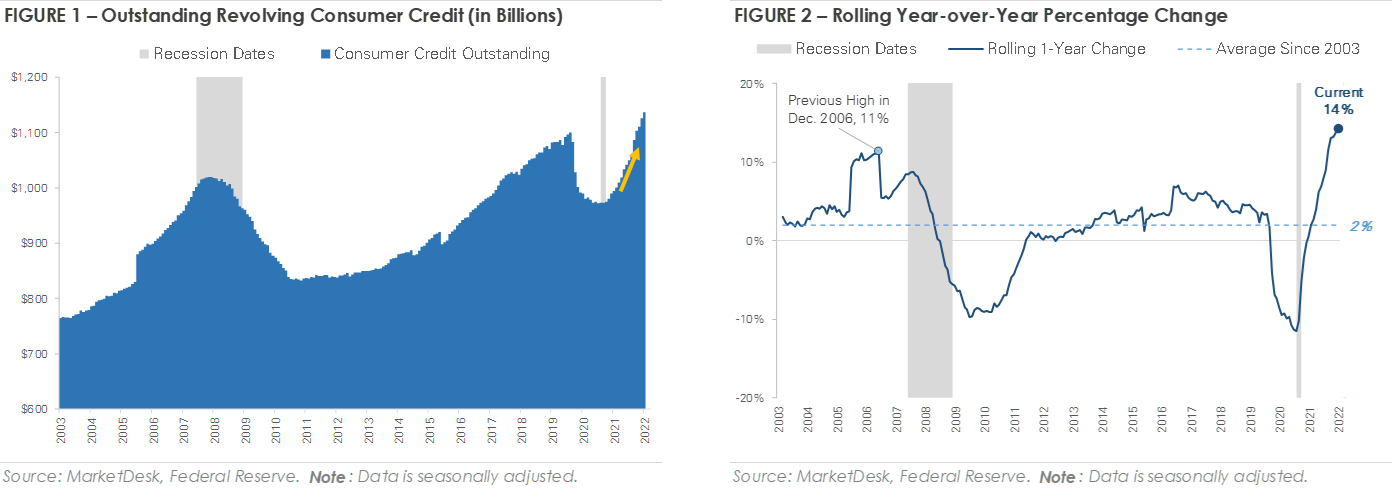

Banks Tighten Lending Standards for Consumer & Business Loans

The above chart depicts the net percentage of banks that have tightened their lending standards across different loan categories, such as consumer loans, credit cards, commercial and industrial loans, and multifamily rentals.

The tightening of lending standards can manifest in several ways, such as increased creditworthiness requirements, higher interest rate spreads, reduced maximum loan sizes, and shorter maturities. Banks may also require more collateral, impose more restrictive loan covenants, and raise loan-to-value ratios.

Tighter lending standards may impede economic growth by limiting credit availability and borrowers’ ability to invest and borrow. This tightening could decrease the overall credit supply, making it challenging for borrowers, particularly high-yield issuers, to refinance their maturing loans, thereby increasing the risk of default.

To mitigate this risk, investors may consider owning bonds from high-quality companies with low refinancing risk.

The recent bank failures and concerns about the stability of checking deposits may also tighten lending standards further. Banks may adopt a more cautious lending approach and further reduce the total amount of credit they offer due to the uncertain timing of depositor withdrawal requests.

This could decrease credit supply and access to credit, which could eventually impact the economy and financial markets.

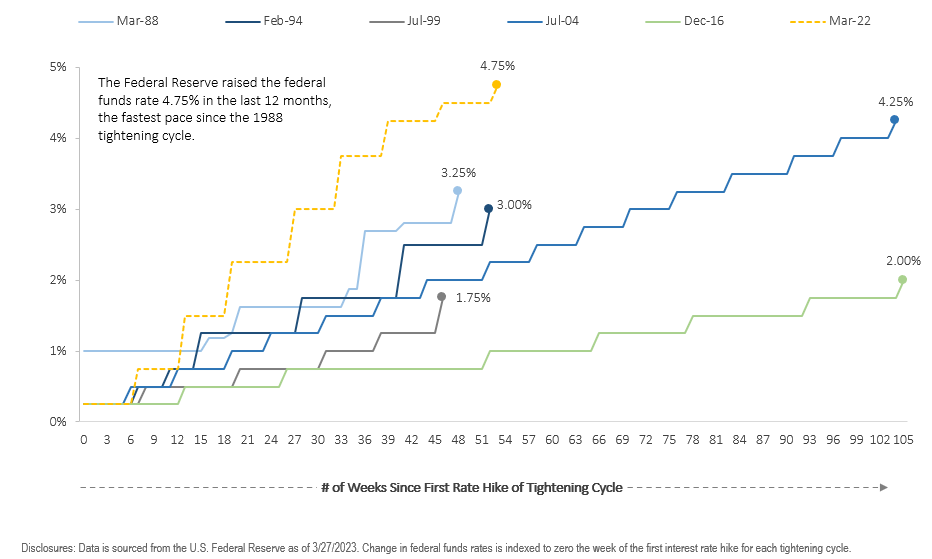

A Look at Interest Rate Increases Across Tightening Cycles

The current tightening cycle, which began in March 2022, is significantly more aggressive when compared to the last five tightening cycles. The Federal Reserve has increased the federal funds rate by 4.75% over the past 12 months, the quickest rate of increase since the 1988 tightening cycle.

The central bank’s next meeting is scheduled for May 2-3, but it is unclear if it will continue to raise interest rates following recent bank failures.

The rapid interest rate hikes have already had multiple consequences.

Bond prices declined in 2022, weighing on the fixed-income portion of portfolios. This decline also contributed to the recent bank failures, as it reduced the value of bonds on banks’ balance sheets, causing them to realize losses when depositors rushed to withdraw their checking deposits.

However, some effects may not be immediately apparent, as tightening historically occurs with a lag. It takes time for higher interest rates to affect the economy, and there is uncertainty about how the current cycle will play out in the real world.

The direction of central bank policy is still highly uncertain and subject to change as new information becomes available. Regardless of the path, it will have implications for investors’ portfolios.

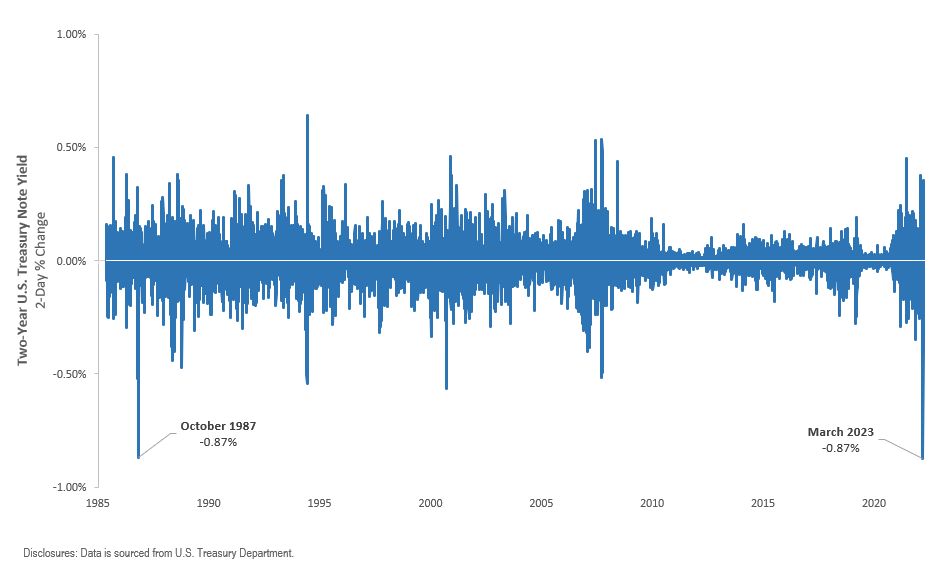

Recent Interest Rate Volatility in the U.S. Treasury Market

Above, we can see the fluctuations in interest rates in the U.S. Treasury market, focusing on the 2-year U.S. Treasury note’s rolling 2-day percentage change in yield since 1985. Inflation and the Federal Reserve’s aggressive interest rate hikes led to increased volatility in 2022, which continued in Q1 2023.

The first quarter of 2023 saw a mix of factors contributing to interest rate volatility. Federal Reserve Chair Jerome Powell’s comments about the possibility of further interest rate hikes, followed by the failure of two regional banks, led to conflicting expectations among investors. The largest two-day drop in the 2-year Treasury yield since 1987 followed as investors became worried about the stability of the U.S. financial system.

The Federal Reserve is now facing the challenging task of balancing inflation control with minimizing damage to the economy and preventing financial market instability.

The uncertainty of how 2022’s rate hikes have affected the economy and recent bank failures are contributing to interest rate volatility. As a result, there is little consensus on the direction of Federal Reserve policy for 2023 and beyond, which may continue to impact interest rate volatility.

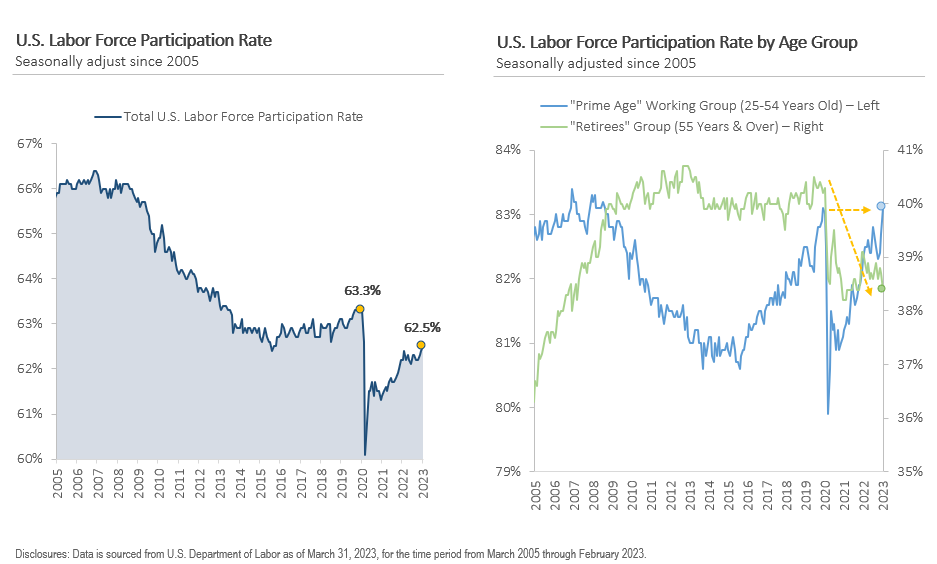

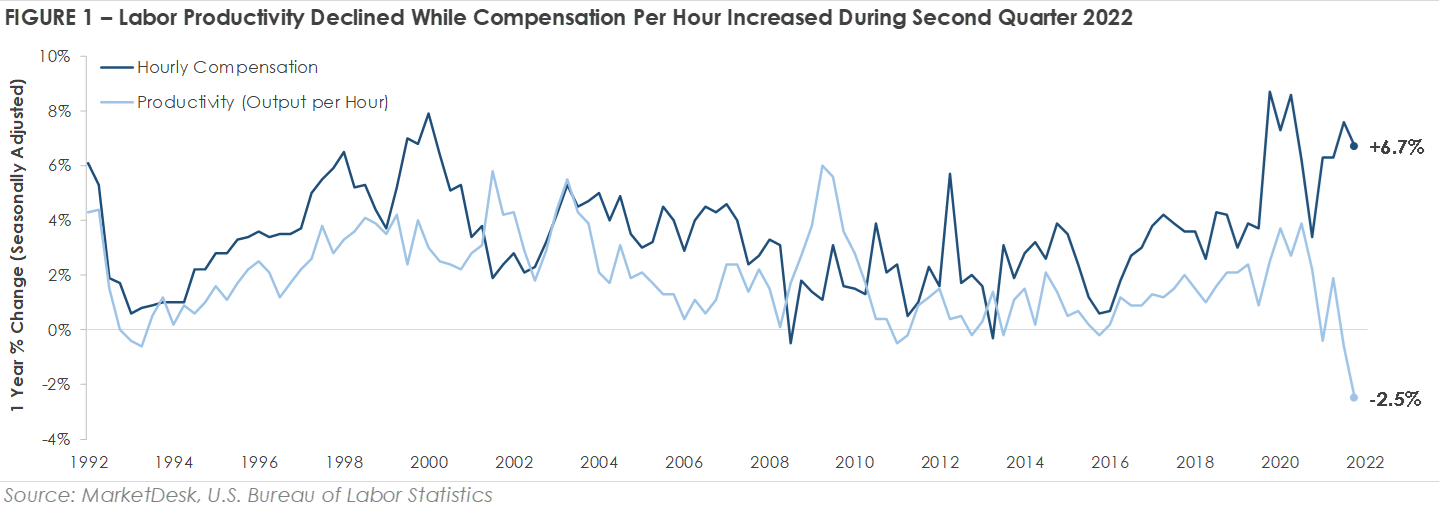

Labor Market Participation Rebounds Despite Early Retirements

The U.S. labor force participation rate, which measures the proportion of individuals who are employed or actively seeking employment is at 62.5% as of February 2023, which is 0.8% lower than its level in February 2020.

Why is the participation rate still below pre-pandemic levels? The answer lies in the age-specific divergence in the participation rate.

To better understand why the participation rate is lower now than in February 2020, we need to take a closer look at two groups: Prime Age (25-54 years old) and Retirees (55 years & over).

During the pandemic, labor participation decreased for both groups as individuals left the labor market due to various reasons, including virus concerns, childcare responsibilities, and early retirements. However, the participation rate for the Prime Age group has surpassed its pre-pandemic level, whereas the Retiree group remains -2% lower than in February 2020 and close to its lowest level since 2007.

The tightness of the labor market contributed to high inflation during the pandemic recovery period. As economic activity surged and labor supply dwindled, businesses struggled to find adequate employees. As a result, employers raised wages to retain current workers and attract new ones, leading to wage inflation.

The rebound in the participation rate has helped moderate wage inflation. However, if the participation rate remains low, the labor market may continue to generate inflationary pressures in the years to come.

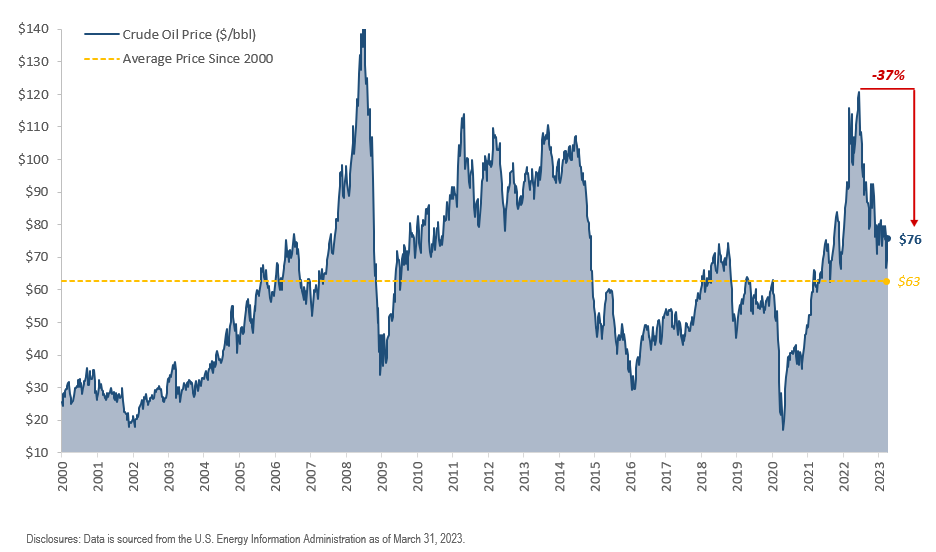

Global Oil Prices Drop to 16-Month Low Due to Demand Concerns

After a sharp decline early in the pandemic, crude oil prices rebounded as the economy stabilized and activity increased in 2020 and 2021.

However, Russia’s invasion of Ukraine in early 2022 disrupted commodity markets, causing oil prices to drop back to 2008 levels. Since then, central banks’ aggressive interest rate increases have negatively impacted demand, resulting in the steepest first-quarter drop in crude oil prices since 2020.

The decrease is attributed to concerns about a potential U.S. recession, robust Russian oil flows despite sanctions, and bank failures, which have raised concerns that tighter lending standards may slow economic activity and decrease demand for oil.

However, Asia is showing signs of demand recovery as China reopens its economy after ending its Covid Zero policy in late 2022.

While the steady rise in oil prices in the past has led to a surge in global inflation, recent data indicates that inflationary pressures are easing, with year-over-year inflation growth declining each month since peaking at +8.9% y/y in June 2022.

If crude oil prices remain stable or continue to decline, it could help to alleviate inflation pressures and allow central banks to slow down their tightening pace. But if oil prices rebound, inflationary pressures could persist.

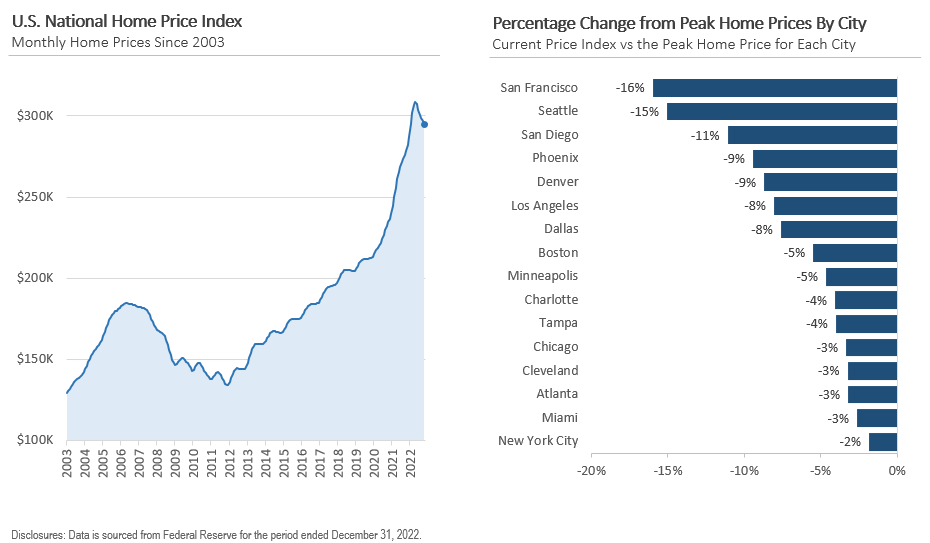

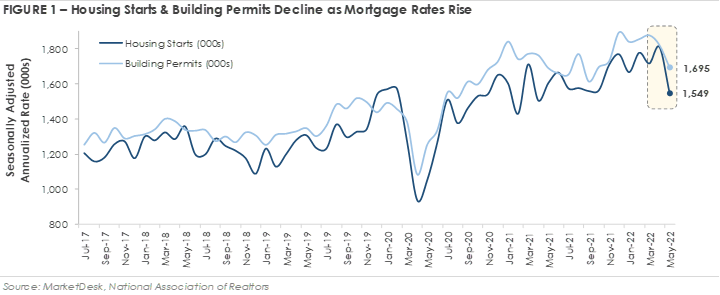

Is the Housing Market Cooling Off?

Home prices sharply increased in 2020 as a result of historically low mortgage rates and an increase in demand from remote work and migration. Consequently, some cities saw year-over-year increases of 15% or more in home prices.

In the second half of 2022, home prices started to decline due to the Federal Reserve’s interest rate hikes. The average 30-year fixed-rate mortgage has risen to levels not seen since 2007, making monthly payments more expensive and reducing demand for homes. As a result, home prices have fallen across most U.S. cities, and there could be further room for decline as mortgage rates remain high and lending standards tighten.

Nevertheless, one stabilizing factor could be that homeowners who secured low-interest rates in recent years may have little incentive to sell their homes and obtain new loans at current interest rates. This limited housing supply may prevent a significant decrease in home prices.

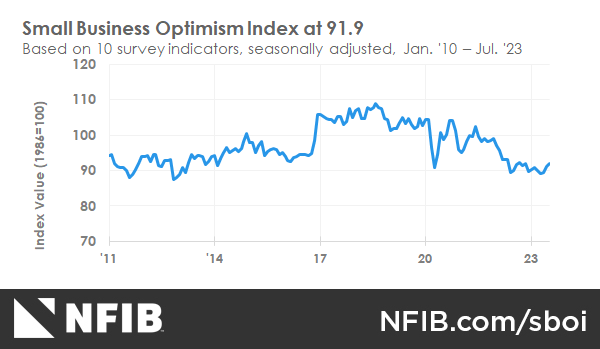

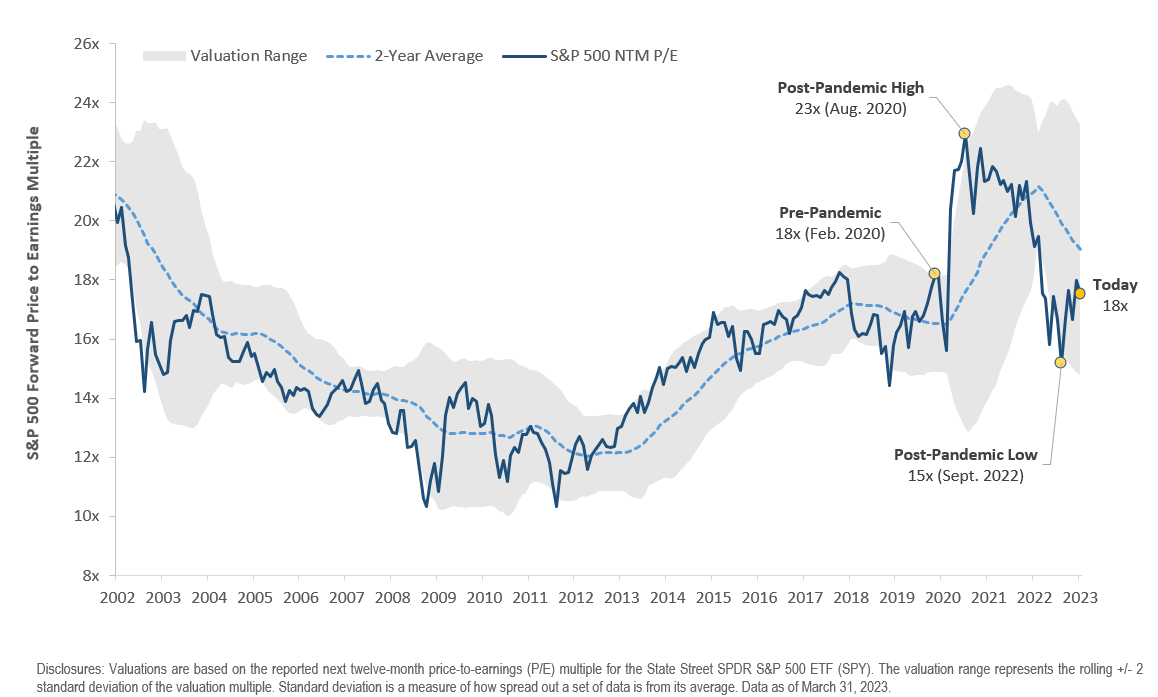

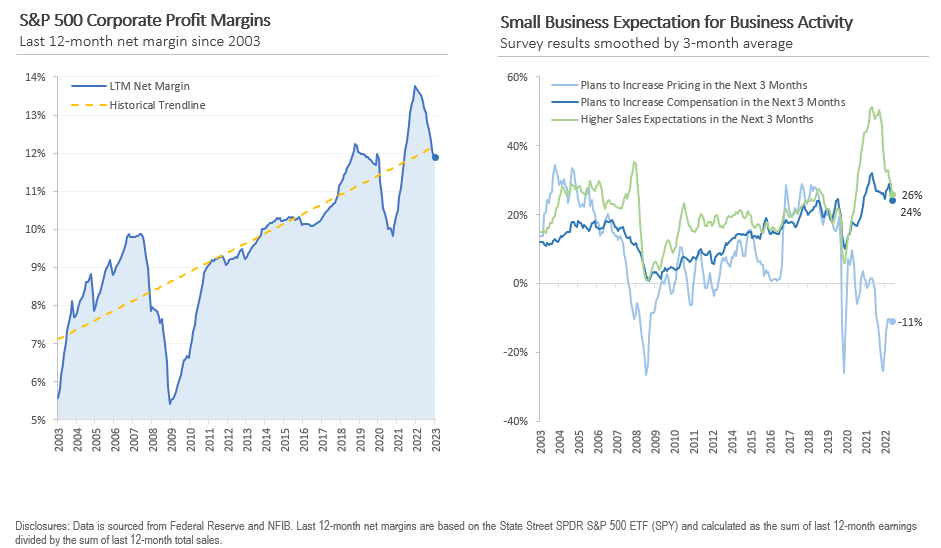

Corporate Profit Margins & Small Business Survey Results

Finally, let’s review the corporate profit margins and the latest survey of small business owners.

On the left side, the above chart displays the S&P 500’s profit margins for the past 12 months on a quarterly basis since 2003. The two main points to highlight are that corporate profit margins increased significantly during the pandemic due to the robust economy and pricing power.

However, profit margins usually decline when the economy contracts. Profit margins have been decreasing lately, and investors will monitor earnings closely to observe if margins will stabilize in the upcoming quarters.

On the right side, the chart illustrates the outcomes of the National Federation of Small Business survey, which measures the sentiment and confidence of U.S. small business owners monthly. Small business owners foresee a rise in wages and prices over the next three months, but the sales outlook is predicted to be weaker, with expectations of lower sales.

Pricing power and expense management will be critical to maintaining profit margins, especially with the possibility of demand declining.