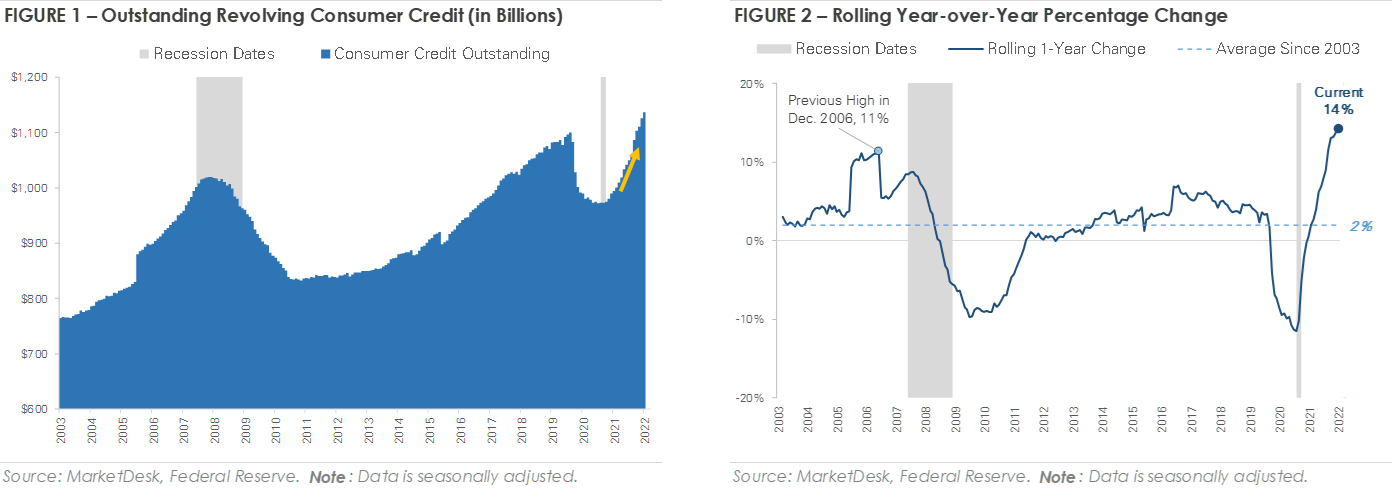

This month’s charts examine the trend of increasing consumer credit usage. Figure 1 charts the amount of outstanding revolving consumer credit, and Figure 2 charts the year-over-year percentage growth of revolving credit. Revolving credit, such as a credit card, allows the account holder to borrow money repeatedly up to a set credit limit while making monthly payments. The charts show credit usage initially decreased during the pandemic as consumers used government stimulus checks and savings from fewer discretionary purchases to pay down debt.

After declining during the pandemic, data shows consumer credit usage is rising again and now back above pre-pandemic levels. The increase in credit usage started during 2021 as the effect of stimulus checks faded and the economic reopening released a wave of pent-up demand. Credit usage continues to increase during 2022 as inflation increases the price of everyday necessities, such as gas, groceries, and housing.

The increase in consumer credit usage raises an important point. Credit cards are an easy and common way to borrow money, but they are also one of the most expensive forms of borrowing. Most credit cards charge a variable interest rate tied to the prime rate, which is linked to the federal funds rate.

This year’s interest rate increases by the Federal Reserve are intended to ease inflation pressures, but they also make carrying a credit card balance more expensive. An increase in the federal funds rate increases the prime rate, which in turn increases the interest rate charged on credit cards. According to a recent survey by Bankrate.com, the average credit card interest rate reached 17.96% at the end of August, which marks the highest level since 1996.

The increase in mortgage and auto loan rates is getting all the attention this year, but the increase in credit card interest rates is more impactful to everyday life. Credit cards are a valuable tool to manage your personal finances, such as building up a credit score, increasing your purchasing power, and earning rewards. However, credit cards can also create negative issues, such as overspending, high balances, and high interest expenses, when misused and mismanaged.