When constructing an investment model, risk management is a critical aspect of portfolio construction and performance evaluation.

While traditional measures like standard deviation and variance have been a favorite risk gauge by many investors, the Ulcer Index (UI) — a less conventional but highly insightful metric — offers a unique perspective by focusing specifically on downside risk.

How the Ulcer Index Works

Developed by Peter Martin and Byron McCann in the 1980s, the Ulcer Index quantifies the depth and duration of drawdowns in an investment’s value (Martin & McCann, 1989).

Unlike other risk measures that consider overall volatility, the Ulcer Index specifically focuses on the negative movements of an asset’s price.

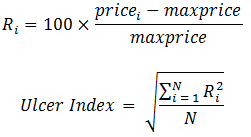

To calculate the Ulcer Index, we must first identify the drawdowns, which are the peaks-to-trough declines in the investment’s value.

The Index then squares these percentage drawdowns and averages them over a specific period, and the square root of this average gives the Ulcer Index value.

- Pricei is the price on day i

- N is the length of time (measured in days)

- maxprice is the most recent high

- Ri is the drawdown from the previous high

A higher Ulcer Index indicates a security or portfolio that has experienced large and/or lengthy drawdowns, signaling higher downside risk.

The Ulcer Index in Action

Consider an investor comparing two exchange-traded funds (ETFs). Fund A has an Ulcer Index of 14.63, while Fund B has an Ulcer Index of 25.17.

Despite a lower Ulcer Index, Fund A has outperformed Fund B due to having smaller periods of decline compared to Fund B, indicating that Fund A could improve portfolio performance while reducing risk.

Source: FastTrack

Benefits of Using the Ulcer Index in Portfolio Construction

1) Enhanced Risk Management: The Ulcer Index allows investors to quantify and manage the downside risk in their portfolios effectively. It is particularly useful in turbulent market conditions where traditional volatility measures might not fully capture the risk of significant losses.

2) Informed Asset Allocation: By using the Ulcer Index, investors can make more informed decisions about asset allocation. For instance, incorporating assets with lower Ulcer Index values can reduce the overall portfolio’s risk of substantial drawdowns.

3) Risk-Adjusted Performance Evaluation: The Ulcer Index complements other performance metrics like the Sharpe Ratio, providing a more comprehensive view of a portfolio’s risk-adjusted performance. It is especially beneficial for comparing investments with similar returns but differing risk profiles.

4) Alignment with Investor Risk Tolerance: The Ulcer Index can help align investment choices with an investor’s risk tolerance. Those particularly sensitive to losses may prefer investments with lower Ulcer Index values.

Academic Research on the Ulcer Index

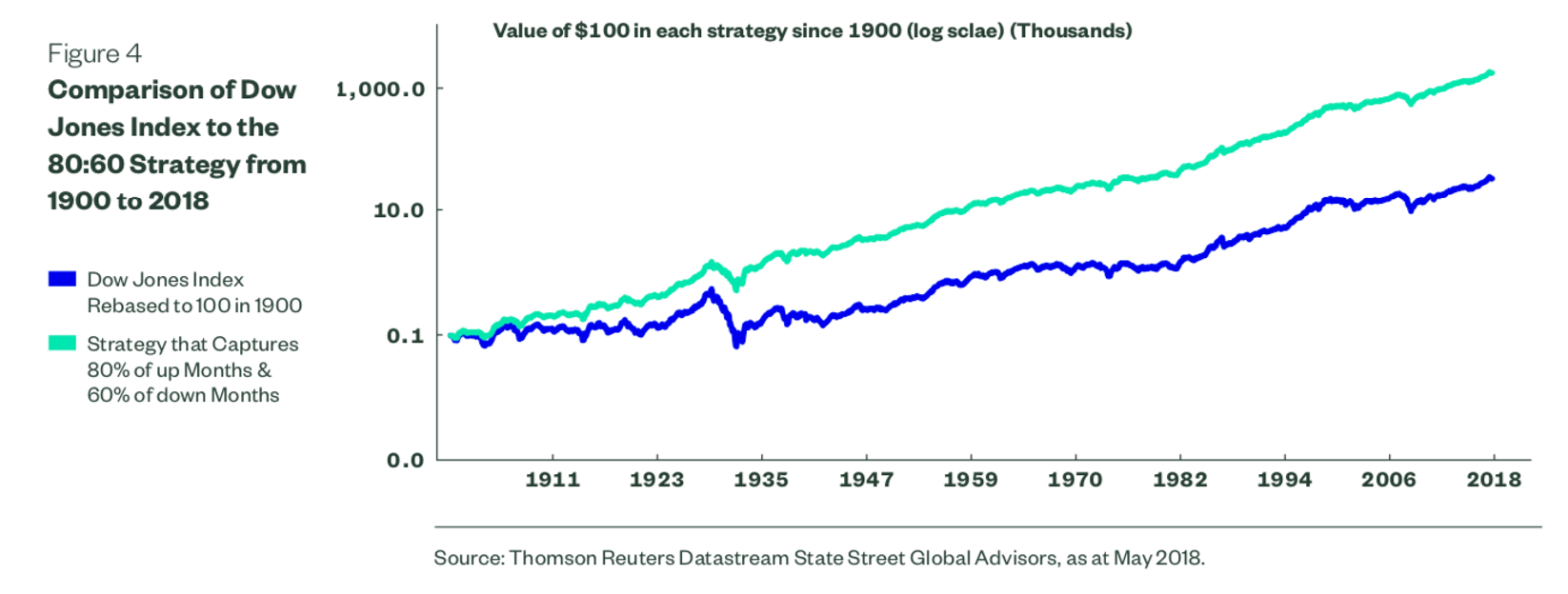

Managing risk can help improve overall portfolio performance

Academic research has provided valuable insights into the benefits of the Ulcer Index.

A study by Chekhlov, Uryasev, and Zabarankin (2005) emphasized the importance of focusing on downside risk and how the Ulcer Index could be a more representative tool for capturing this risk compared to standard deviation.

This aligns with the principles of behavioral finance, where investors are often more concerned about potential losses than equivalent gains (Kahneman & Tversky, 1979).

In portfolio optimization research, the Ulcer Index has been used as a constraint or objective to construct portfolios that not only have optimal returns, but also minimal potential for significant drawdowns (Post & Van Vliet, 2006).

This approach is particularly relevant in the construction of retirement portfolios, where preserving capital is often more critical than achieving high returns.

The Ulcer Index: An Important Tool in an Investor’s Toolbox

The Ulcer Index stands out as a specialized tool in the investor’s arsenal, particularly valuable for its focus on downside risk.

While not a standalone solution, it complements other risk and performance measures, offering a nuanced perspective on investment risk.

For investors and financial professionals alike, understanding and applying the Ulcer Index can lead to more robust portfolio construction and a better alignment with investment goals and risk tolerance.

References

- Martin, P. & McCann, B. (1989). “The Investor’s Guide to Fidelity Funds”. Wiley.

- Chekhlov, A., Uryasev, S., & Zabarankin, M. (2005). “Drawdown Measure in Portfolio Optimization”. International Journal of Theoretical and Applied Finance.

- Kahneman, D., & Tversky, A. (1979). “Prospect Theory: An Analysis of Decision under Risk”. Econometrica.

- Post, G. & Van Vliet, P. (2006). “Downside Risk and Empirical Asset Pricing”. Journal of Banking & Finance.