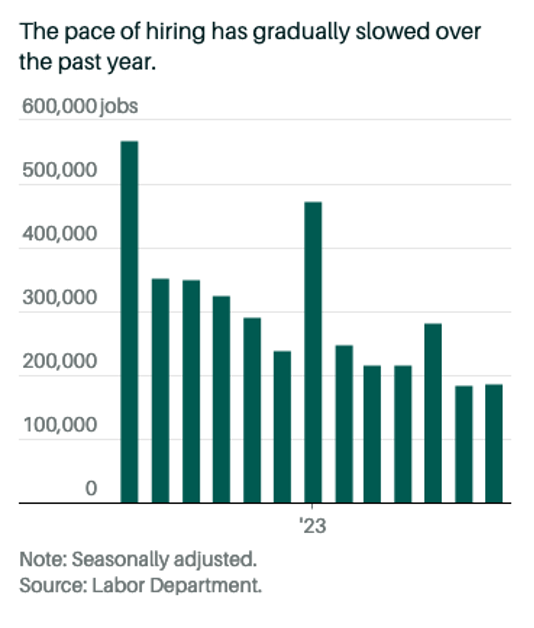

Job Growth in the US Slows to a More Sustainable Pace

The latest job report shows a slowing in U.S. job growth, with employers adding 187,000 jobs in July, which falls short of economists’ forecast of 200,000 positions.

Source: US Dept of Labor

However, there is no cause for alarm as this indicates a shift towards a more sustainable pace, and it still surpasses the average monthly jobs gained pre-pandemic. In fact, the July figure is slightly higher than June’s revised payroll gain of 185,000.

A Move Towards Sustainable Growth

Although the headline number might be disappointing, it is important to understand that the reduced pace is actually a sign of stability rather than weakness.

This growth rate aligns with what some economists consider the long-term capacity of the U.S. labor force, ensuring that growth remains steady and manageable. It represents a maturing recovery where employers are strategically aligning job growth with underlying economic fundamentals.

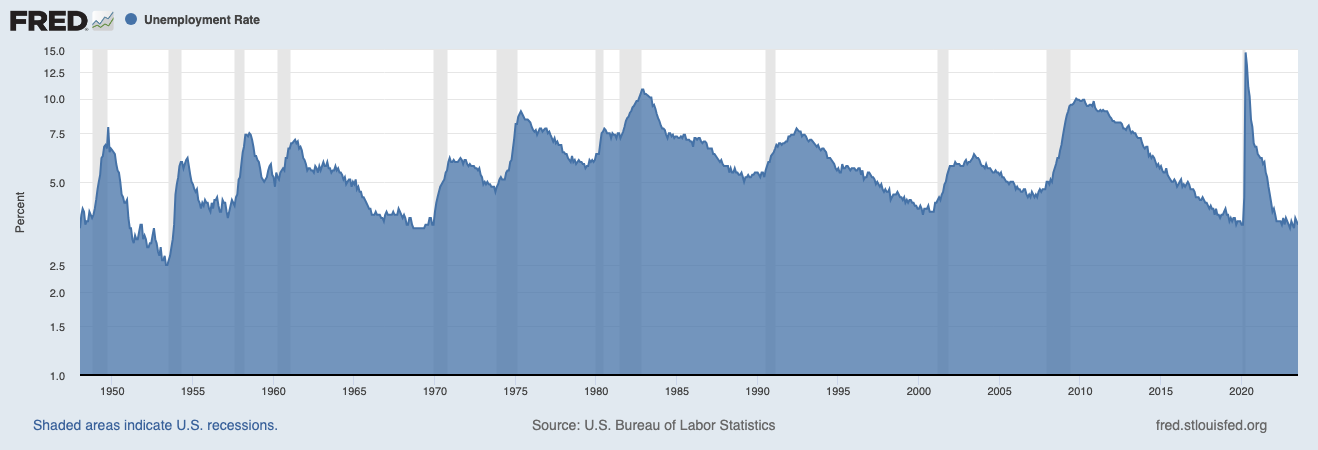

Unemployment Rate and a Tight Labor Market

Another positive development is the decrease in the unemployment rate from 3.6% in June to 3.5% in July, against economists’ expectations of no change. Despite an aggressive Fed, the Unemployment Rate remains at historical lows.

Despite an aggressive Fed, the Unemployment Rate remains at historical lows.

Source: Federal Reserve Bank of St Louis

This decline reinforces the idea of a tight labor market, where employers are competing for workers, potentially leading to wage growth. Such a scenario can boost consumer spending and confidence, thereby driving further economic expansion.

Implications for the Federal Reserve and Interest Rates

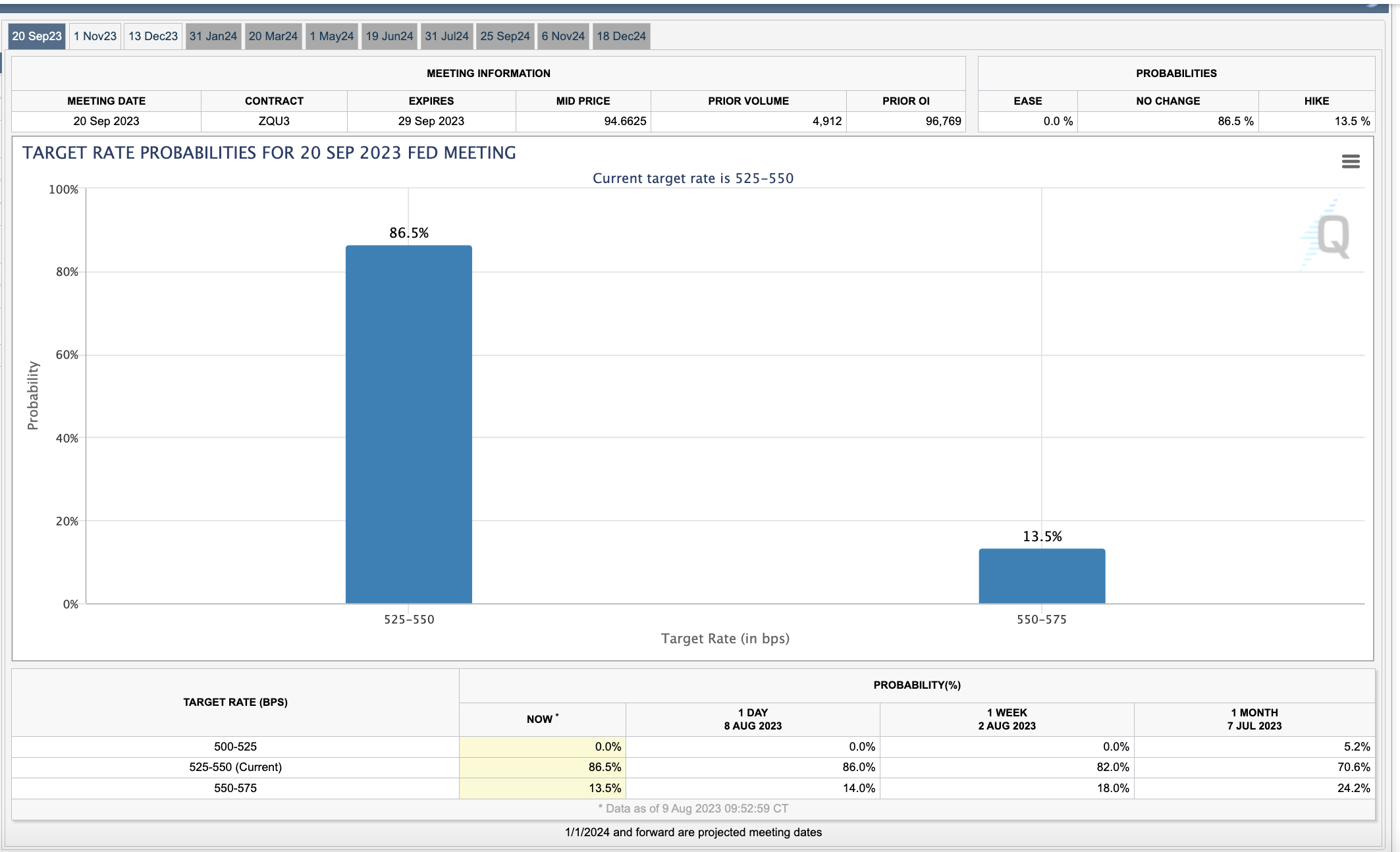

Given the numbers, it doesn’t seem likely that the Federal Reserve will rule out future interest-rate hikes. Despite slower job growth, the continuous expansion and tight labor market may push the Fed to stick with gradual monetary tightening. This can have various effects on investors’ portfolios, especially in sectors sensitive to interest rates, like bonds and financials.

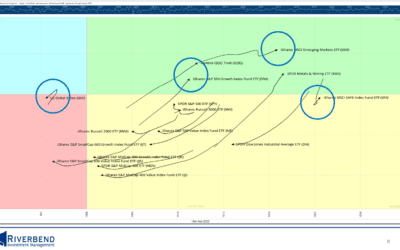

When making investment decisions, keep in mind:

Bonds: Given the possibility of future interest rate hikes, it may be wise to consider short-duration securities with less sensitivity to rate changes.

Equities: Sectors benefiting from economic growth and consumer spending can remain appealing, particularly with potential wage growth driving increased spending.

Dollar & Commodities: Stay vigilant on the U.S. dollar and commodities as their valuations can be impacted by interest rate decisions.

Although July’s job growth might seem underwhelming at first glance, further analysis reveals a trend toward sustainable growth and a tight labor market. Take these dynamics into account when determining your asset allocation and investment strategy, and stay tuned for any interest rate moves by the Federal Reserve.

____

John Rothe, CMT