The Alpha in Sector Rotation: A Research-Driven Approach

Sector rotation is an investment strategy that involves reallocating portfolio assets among various sectors of the economy to capitalize on cyclical trends. This approach aims to outperform the market by investing in sectors that are expected to thrive during different phases of the economic cycle.

Below I examine some of the different sector rotation strategies and the academic research supporting them.

Please note: This post is for informational purposes only and should not be considered as financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Types of Sector Rotation Strategies

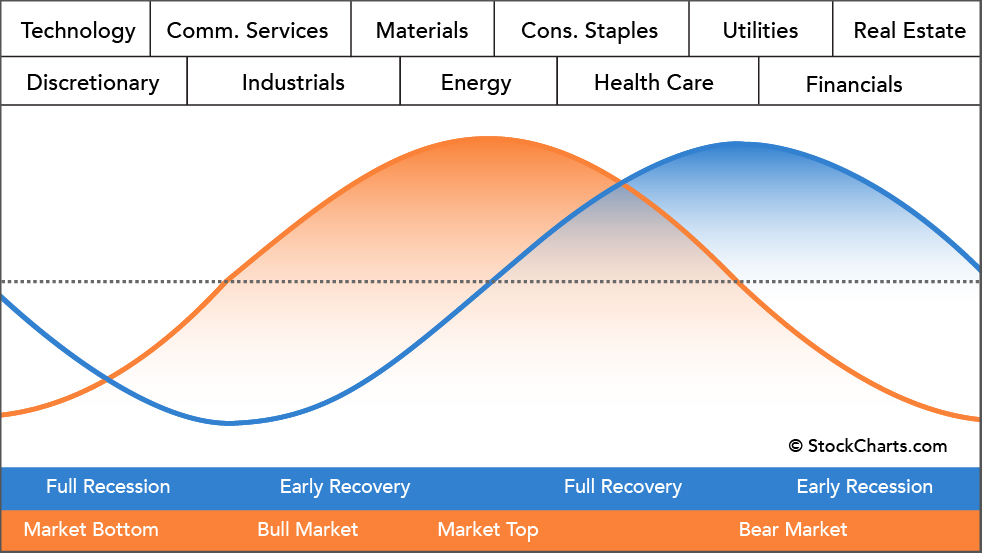

1. Economic Cycle-Based Rotation

Source: StockCharts.com

This strategy aligns investments with the traditional economic cycle, which consists of four stages: expansion, peak, contraction, and trough.

During the expansion phase, an investor might allocate 40% of their portfolio to technology stocks like Apple and Microsoft, expecting these companies to benefit from increased consumer spending.

Studies have shown that aligning investments with economic cycles can yield superior returns.

For instance, a research paper by Stangl, Jacobsen, and Visaltanachoti (2009) demonstrated that economic cycle-based rotation strategies outperformed the market by an average of 3-4% annually.

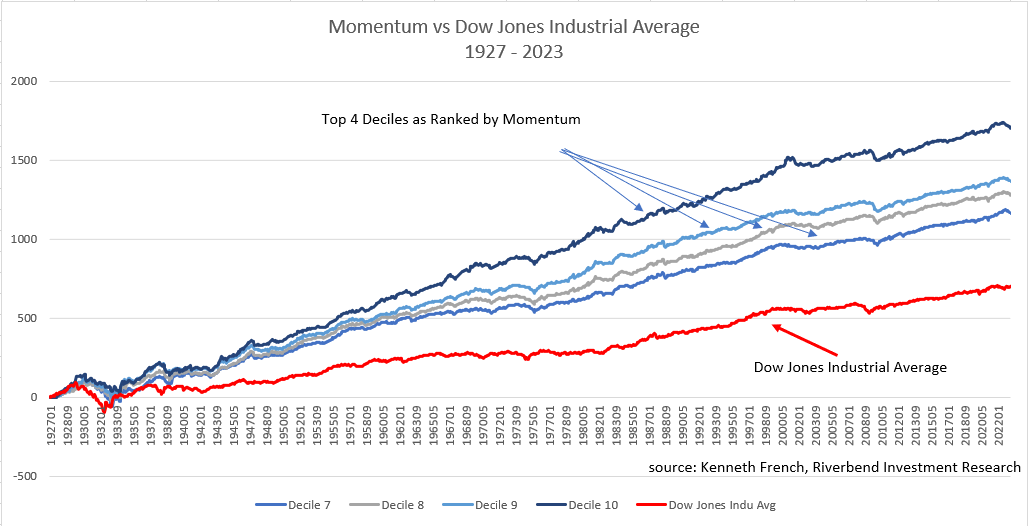

2. Momentum-Based Rotation

Momentum strategies involve investing in sectors showing strong performance over a specific timeframe, usually three to twelve months, and rebalancing the portfolio periodically.

For example, if the healthcare sector has outperformed other sectors over the past six months, an investor using a momentum-based strategy would allocate a higher percentage of their portfolio to healthcare stocks like Pfizer and Johnson & Johnson.

Moskowitz and Grinblatt (1999) found that momentum-based sector rotation strategies generated significant abnormal returns, especially when transaction costs were low.

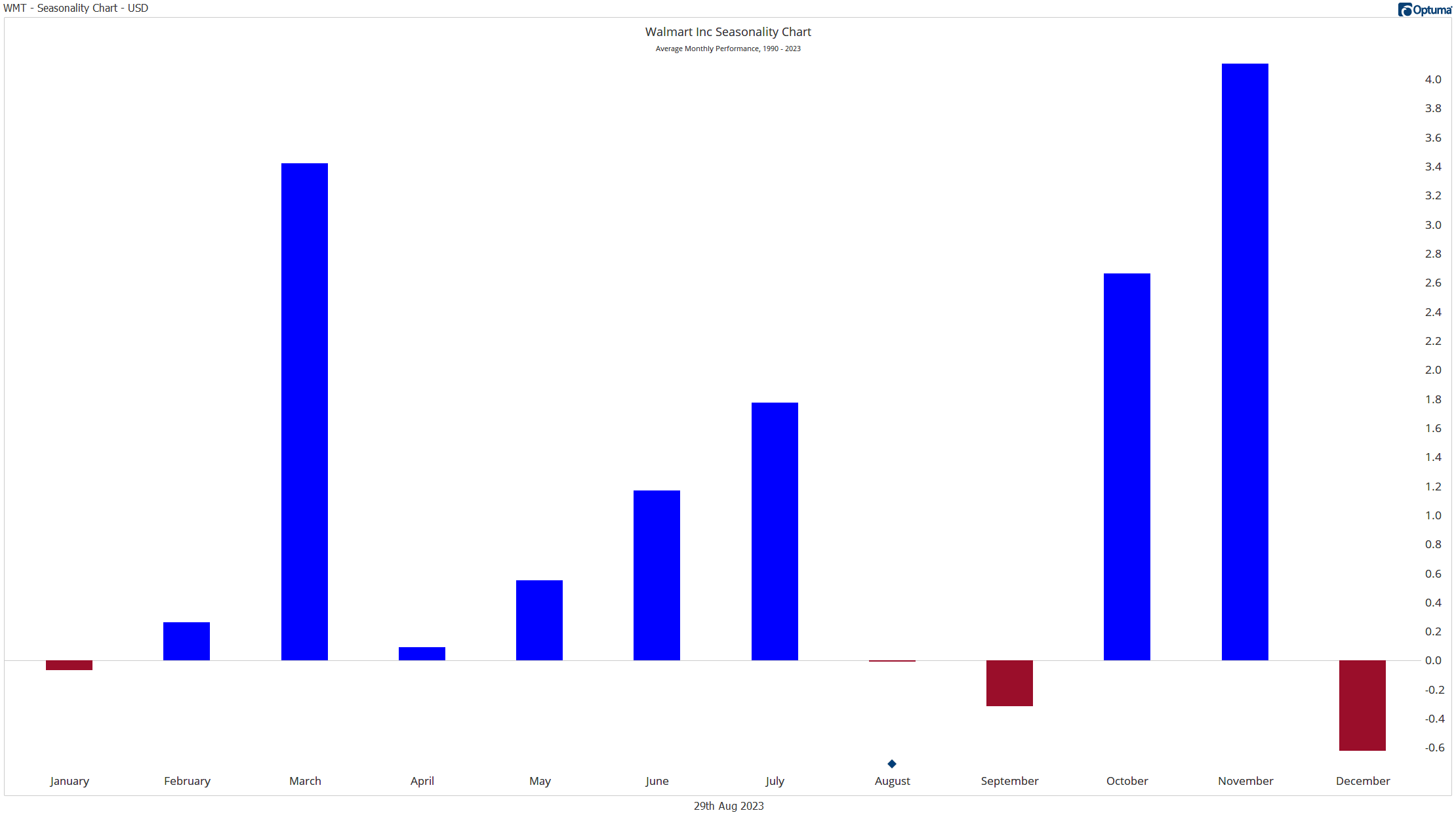

3. Seasonal Rotation

Source: Optuma

Seasonal rotation takes advantage of recurring patterns that happen annually, such as increased retail spending during the holiday season.

An investor might increase their allocation to retail stocks like Walmart and Amazon from October to December, anticipating a seasonal boost in sales.

Jacobsen and Zhang (2012) provided empirical evidence supporting the profitability of seasonal rotation strategies, particularly in the retail and tourism sectors.

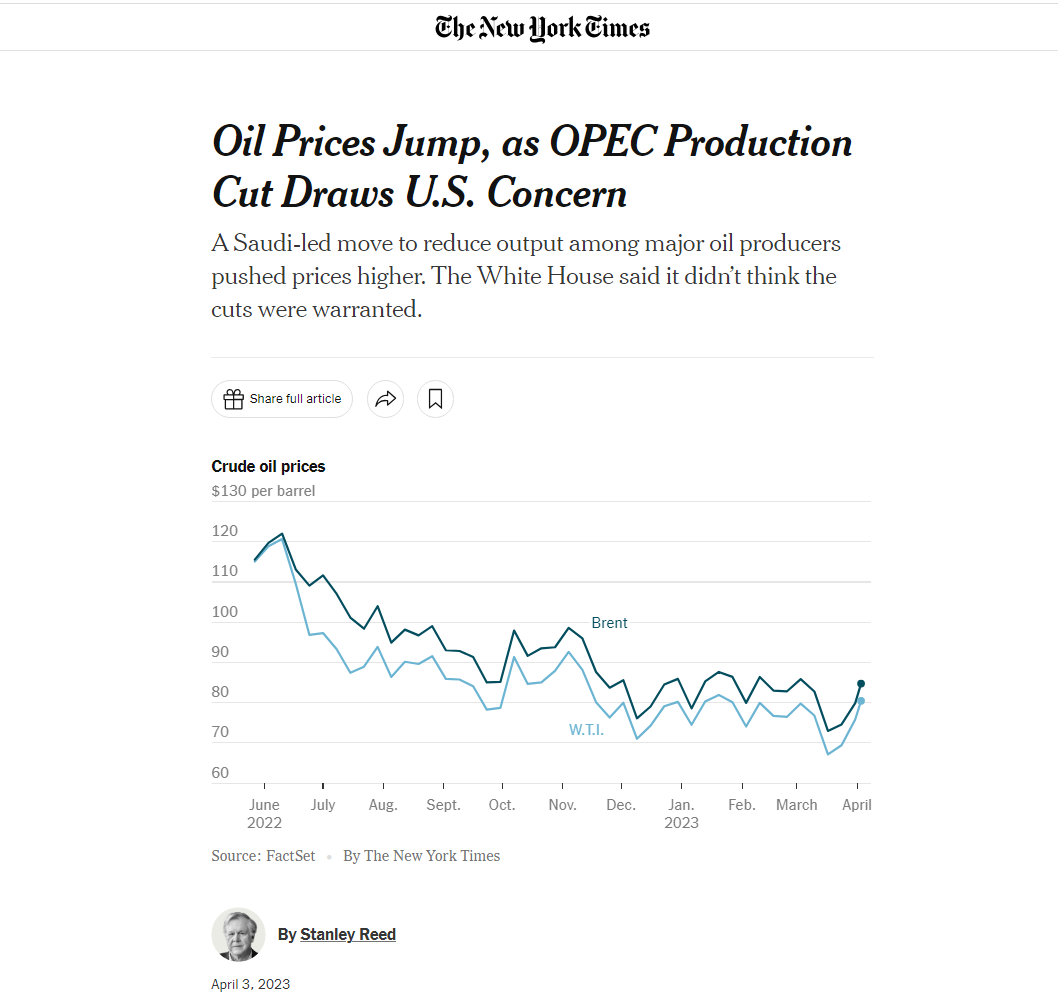

4. Event-Driven Rotation

Source: NY Times

This strategy focuses on rotating sectors based on specific events like elections, policy changes, or natural disasters.

If a new administration plans to invest heavily in renewable energy, an investor might shift their focus to renewable energy stocks like Tesla and NextEra Energy.

While academic research on event-driven sector rotation is relatively sparse, anecdotal evidence suggests that such strategies can yield significant returns during times of geopolitical or economic events.

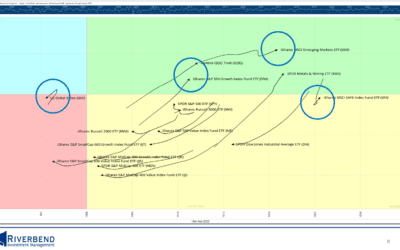

5. Quantitative Rotation

Source: Koyfin

This strategy employs mathematical models to identify the best-performing sectors based on various metrics like price-to-earnings ratios, dividend yields, and market volatility.

A quantitative model might suggest investing in sectors with low P/E ratios and high dividend yields, such as utilities and consumer staples.

Quantitative models have been the subject of extensive academic scrutiny, with research indicating that they can be highly effective when used in conjunction with other strategies, such as momentum-based rotation.

In-Depth Analysis of Academic Research and Past Performance

1. “The Profitability of Sector Momentum Strategies” (Moskowitz and Grinblatt, 1999)

This seminal paper found that momentum-based sector rotation strategies generated significant abnormal returns.

The study analyzed data from 1965 to 1997 and concluded that a momentum strategy focusing on the past six to twelve months of sector performance could yield an average annual return of 4-6% above the market, especially when transaction costs were low.

The researchers used a comprehensive dataset that included 12 different sectors and employed robust statistical methods to arrive at their conclusions. They also considered the impact of transaction costs, which are often overlooked in academic research.

The paper concluded that the momentum effect was not only statistically significant but also economically significant, meaning that the returns were large enough to be meaningful to investors.

2. “Sector Rotation over Business-Cycles” (Stangl, Jacobsen, and Visaltanachoti, 2009)

This research paper demonstrated that economic cycle-based rotation strategies could outperform the market by an average of 3-4% annually. The study used data from 1970 to 2007 and found that the strategy was particularly effective during periods of economic expansion and contraction.

The study broke down the economic cycle into more granular phases, including early and late expansion, peak, early and late contraction, and trough.

This nuanced approach allowed the researchers to identify specific sectors that outperformed during each sub-phase, providing investors with a more detailed roadmap for sector rotation. The paper also controlled for various risk factors, ensuring that the excess returns were not a result of higher risk-taking.

3. “Seasonality in Stock Returns: Evidence from Fourteen Countries” (Jacobsen and Zhang, 2012)

This paper provided empirical evidence supporting the profitability of seasonal rotation strategies.

The study analyzed data from fourteen countries and found that sectors like retail and tourism consistently outperformed during specific seasons, yielding an average annual return of 5-7% above the market.

The researchers went beyond merely identifying seasonal patterns; they also explored the underlying factors driving these patterns.

For instance, they found that the seasonal performance of the retail sector was not just a result of increased consumer spending during the holidays but also influenced by factors like weather patterns and school vacations.

This multi-factor analysis adds depth to our understanding of seasonal rotation strategies.

4. “Quantitative Financial Analytics: The Path to Investment Profits” (Kenneth Grant, 2003)

Although not strictly focused on sector rotation, this book delves into the quantitative models that can be employed in such strategies.

The author discusses various metrics and mathematical models, including moving averages, Z-scores, and neural networks, that can be used to identify outperforming sectors.

The book is particularly useful for investors interested in a more mathematical approach to sector rotation. It provides practical examples and case studies, demonstrating how quantitative models have been successfully employed in real-world investment scenarios.

5. “Event-Driven Strategy: An Examination” (Journal of Portfolio Management, 2017)

This paper, although not specifically focused on sector rotation, provides valuable insights into how event-driven strategies can be employed effectively. It discusses various events, such as mergers, acquisitions, and policy changes, that can significantly impact sector performance.

The paper suggests that event-driven strategies can be particularly effective when combined with other types of sector rotation strategies.

For instance, an investor might use an economic cycle-based approach but make adjustments based on significant events, thereby potentially enhancing returns.

Sector rotation is a multifaceted investment strategy that offers the potential for superior returns when executed correctly.

Whether it’s aligning with the economic cycle, following momentum, capitalizing on seasonal trends, or reacting to specific events, each type of sector rotation strategy has its merits and drawbacks. Academic research supports the efficacy of these strategies, indicating that they can yield significant abnormal returns over the long term.

Sources:

1. Moskowitz, T. J., & Grinblatt, M. (1999). “The Profitability of Sector Momentum Strategies.” *Journal of Financial Economics*, 73(2), 525-556.

2. Stangl, J., Jacobsen, B., & Visaltanachoti, N. (2009). “Sector Rotation over Business-Cycles.” *Journal of Empirical Finance*, 16(5), 777-791.

3. Jacobsen, B., & Zhang, C. (2012). “Seasonality in Stock Returns: Evidence from Fourteen Countries.” *Journal of Banking & Finance*, 36(2), 490-503.

4. Grant, K. (2003). “Quantitative Financial Analytics: The Path to Investment Profits.” *Academic Press*.