Why the S&P 500 Feels Stuck—and What to Watch Next

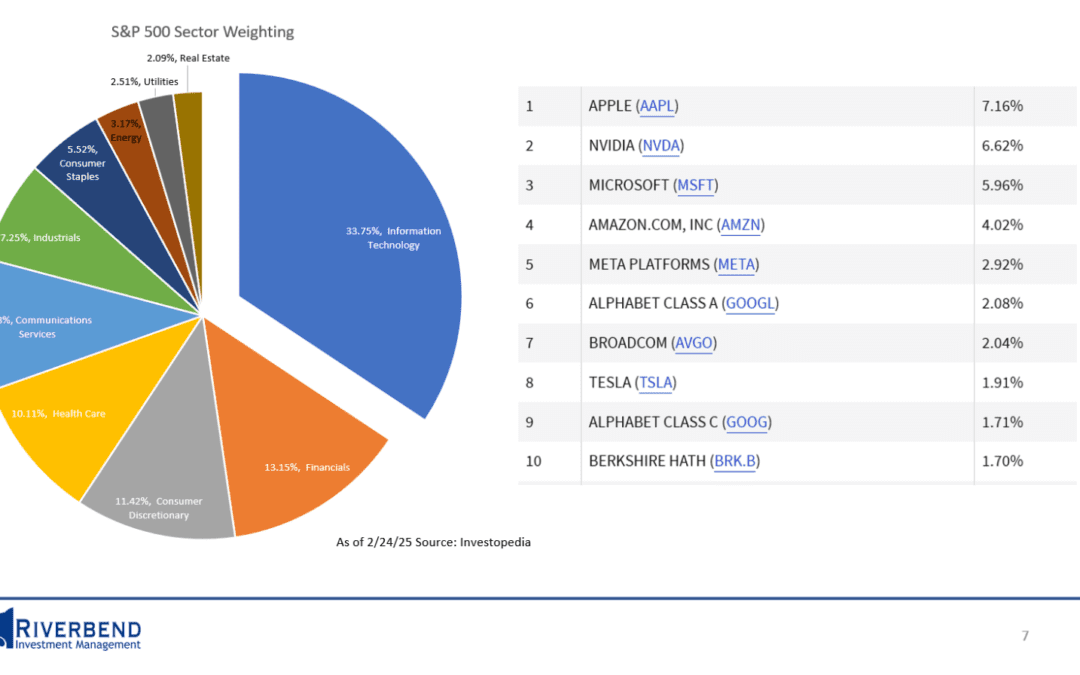

If you’ve felt like the S&P 500 is “stuck” despite constant bullish headlines, it’s worth looking at what the index is actually made of—and what’s driving it right now.

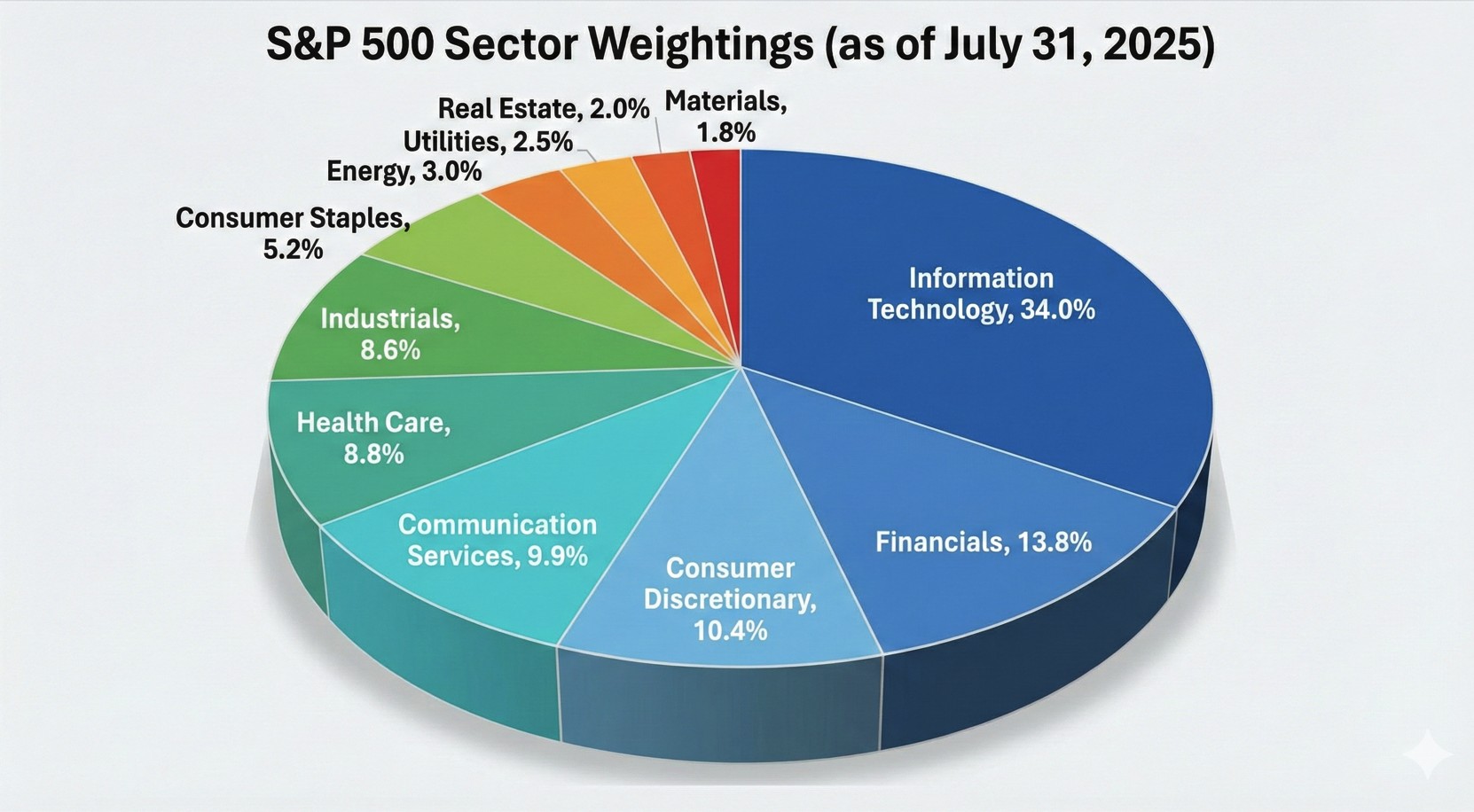

Because tech is such a large portion of the S&P 500’s weight, when mega-cap tech cools off or chops sideways, it can quietly stall the entire index – even if many other stocks are doing fine.

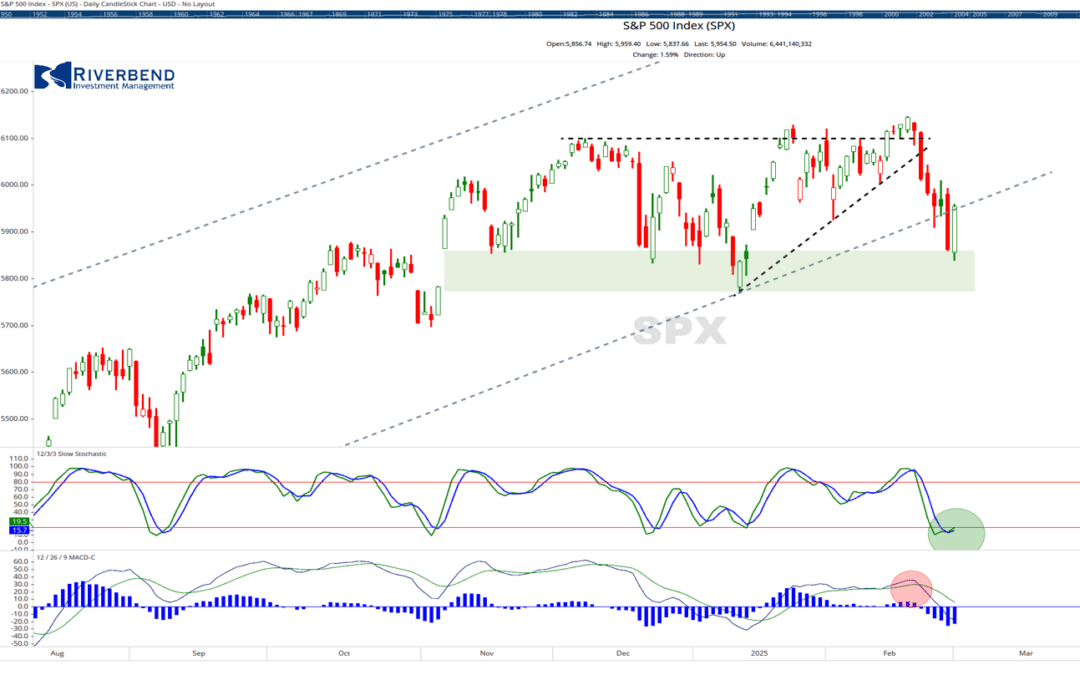

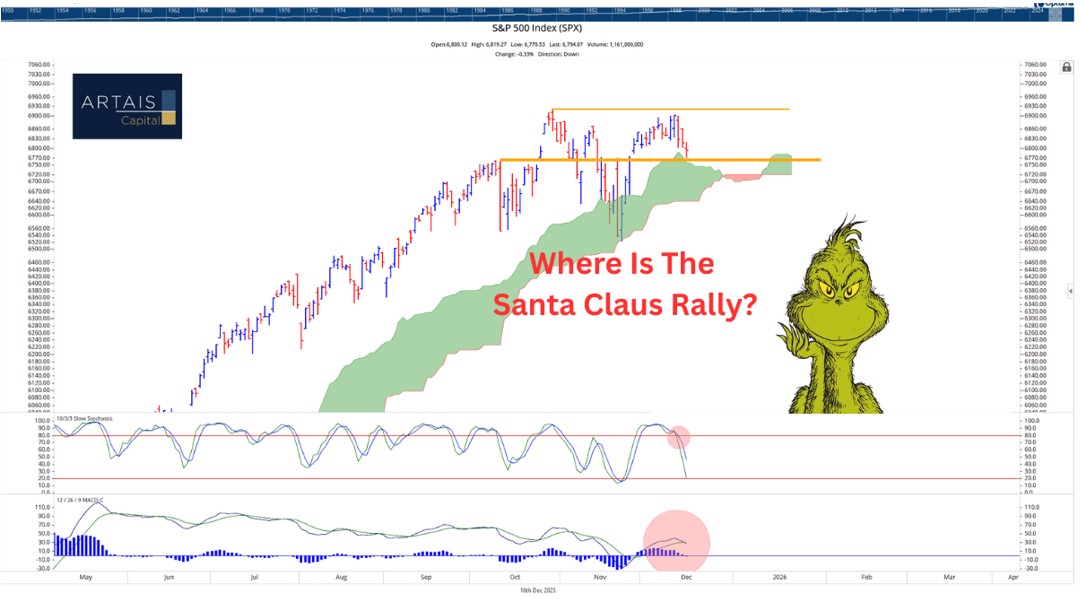

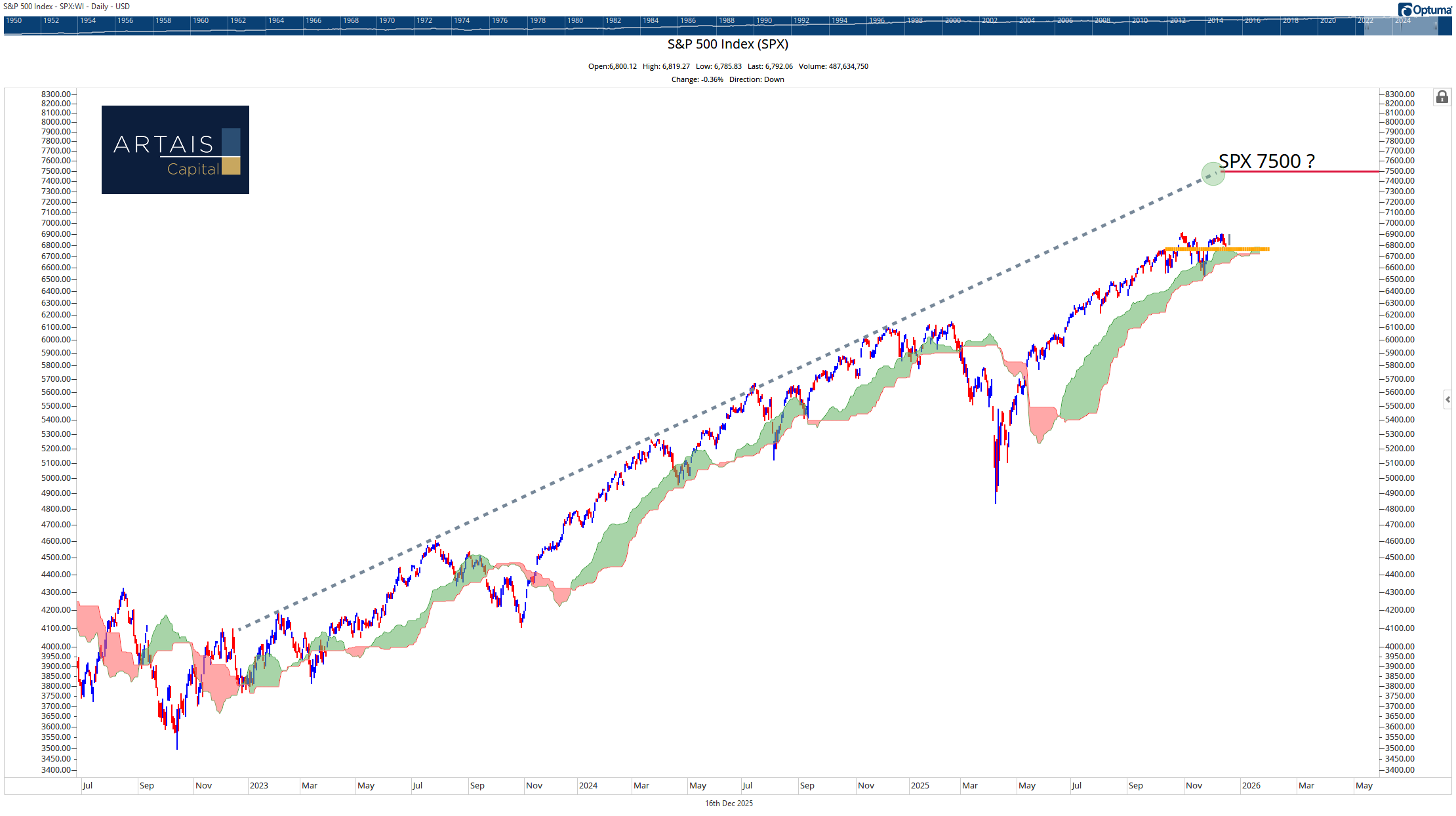

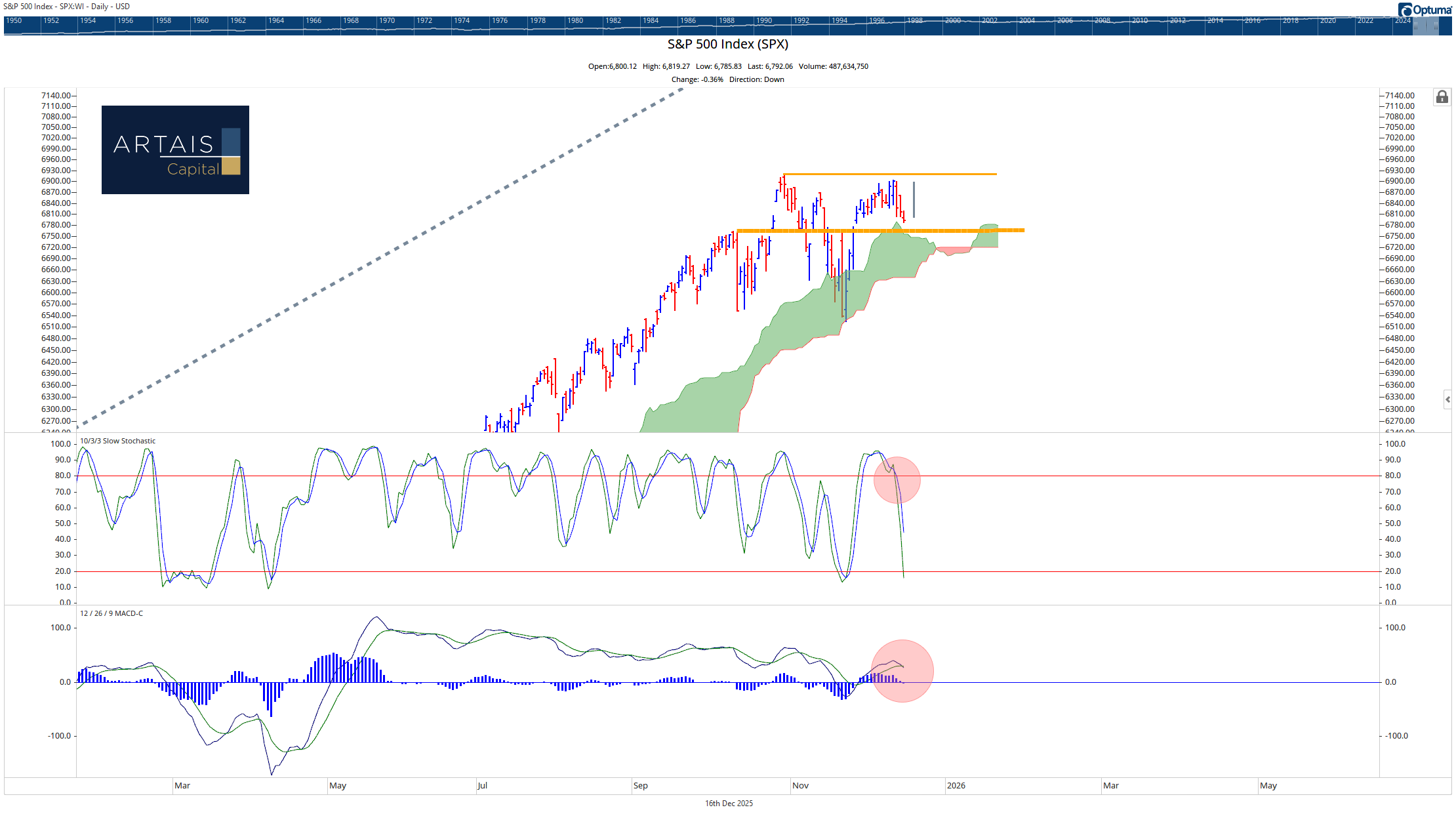

S&P 500 Index

To start, let’s take a look at the S&P 500 index. I’ve highlighted the upper channel. As you can see, it is very well defined, giving us a 7,500 projection level, once the index starts moving higher again.

“once the index starts moving higher again”?

You might be saying, “John, I keep hearing the market is near an all-time high!”

Yes, this is true; however, the index has been in a sideways trading range since October:

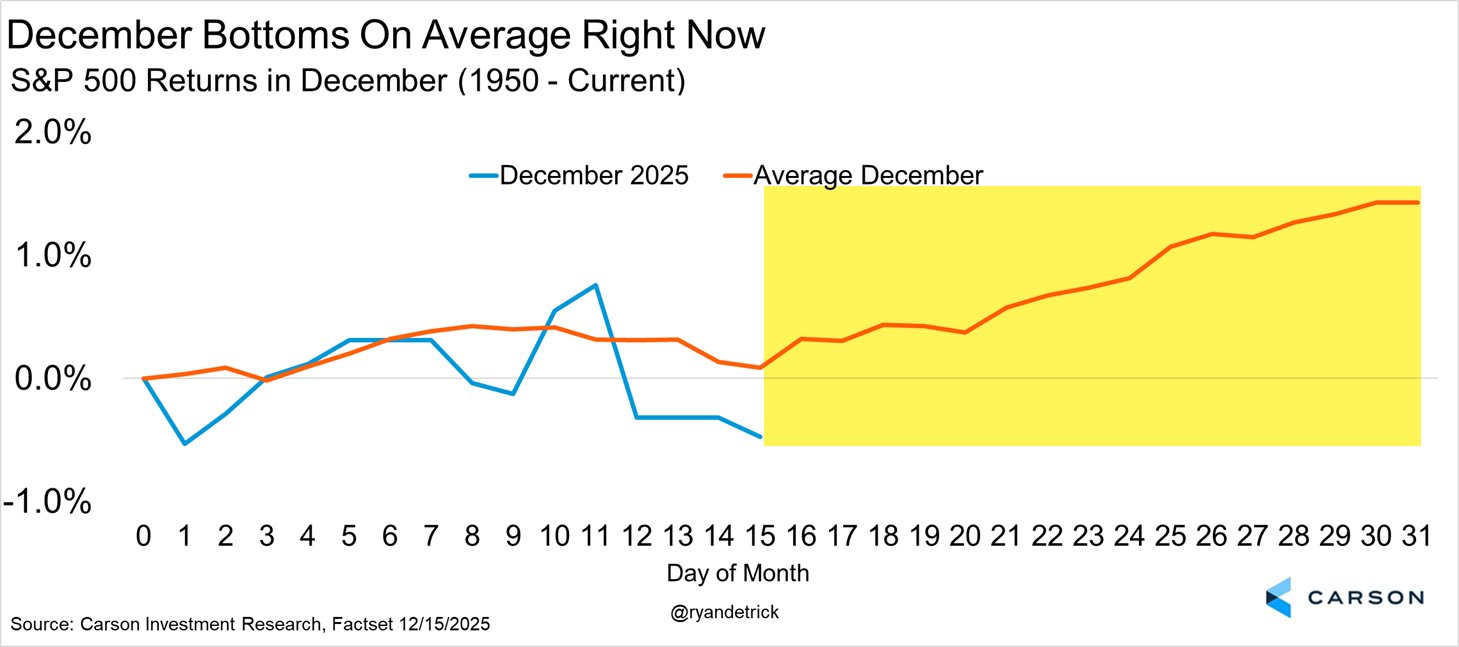

Typically, this time of year is when we start the Santa Claus rally cycle, however the lack of upside movement from technology leadership names has stalled the index.

Note: I should mention that other sectors of the market are having their so-called Santa Claus rally – especially small-cap names – the large leadership tech names are just weak in comparison.

A Closer Look at Tech

So, what’s going on with tech?

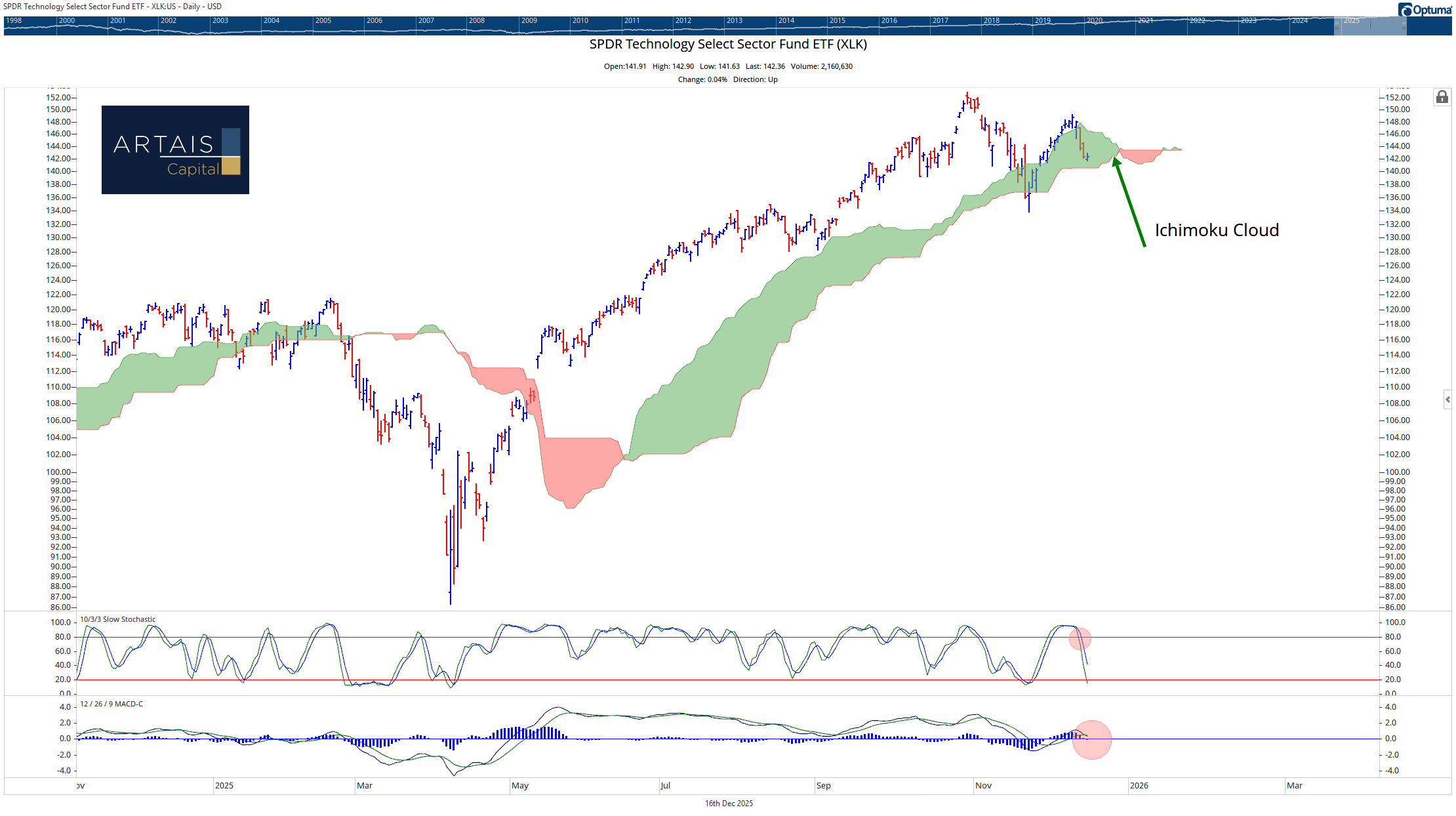

Taking a look at the SPDR Technology Select Sector Fund ETF (XLK), we can see a few notable developments:

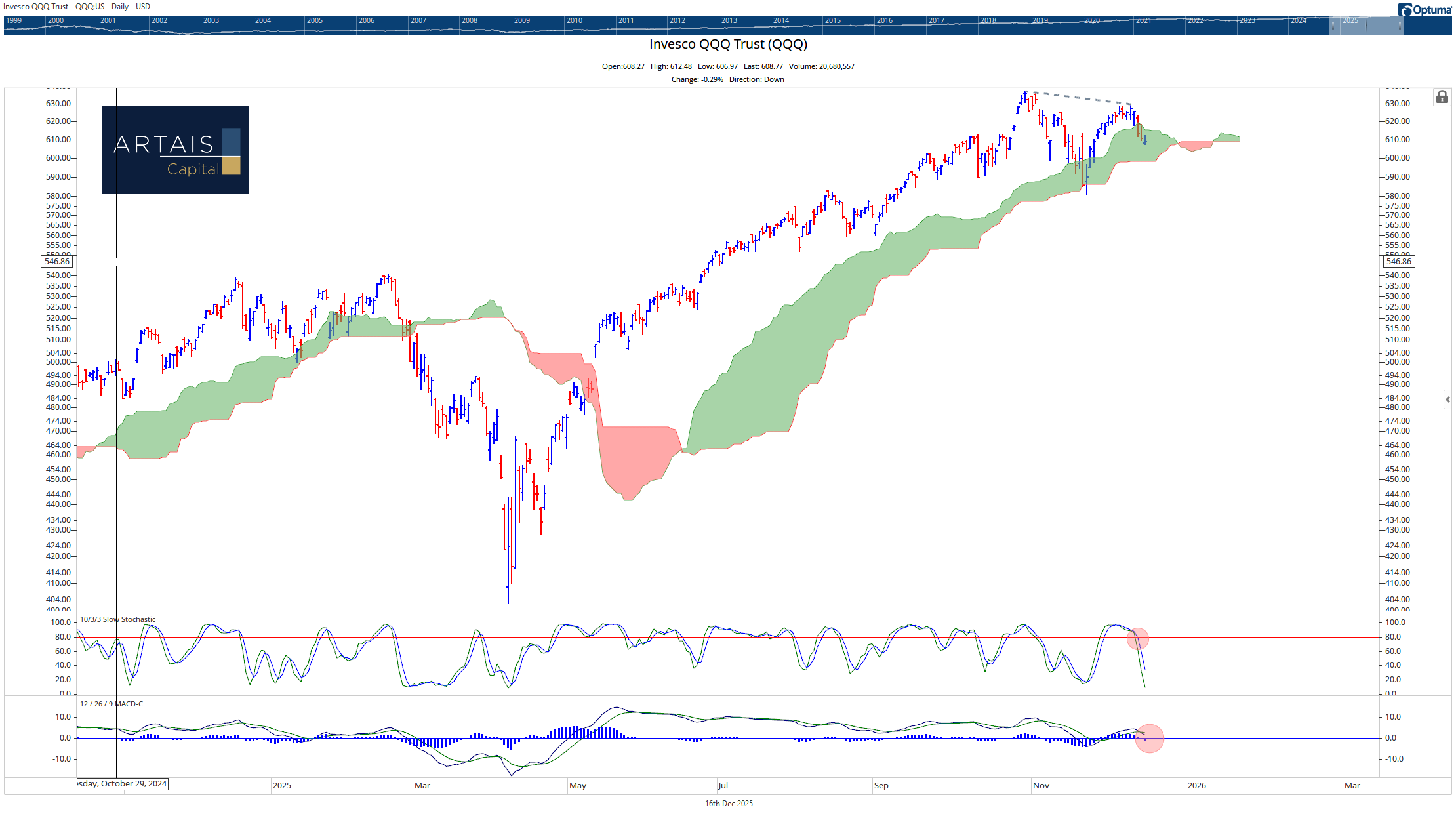

First, XLK has retreated from being short-term overbought, as shown in the Stochastics panel at the bottom of the chart. Below that, a MACD sell signal is also forming – indicating a slowdown in upside momentum.

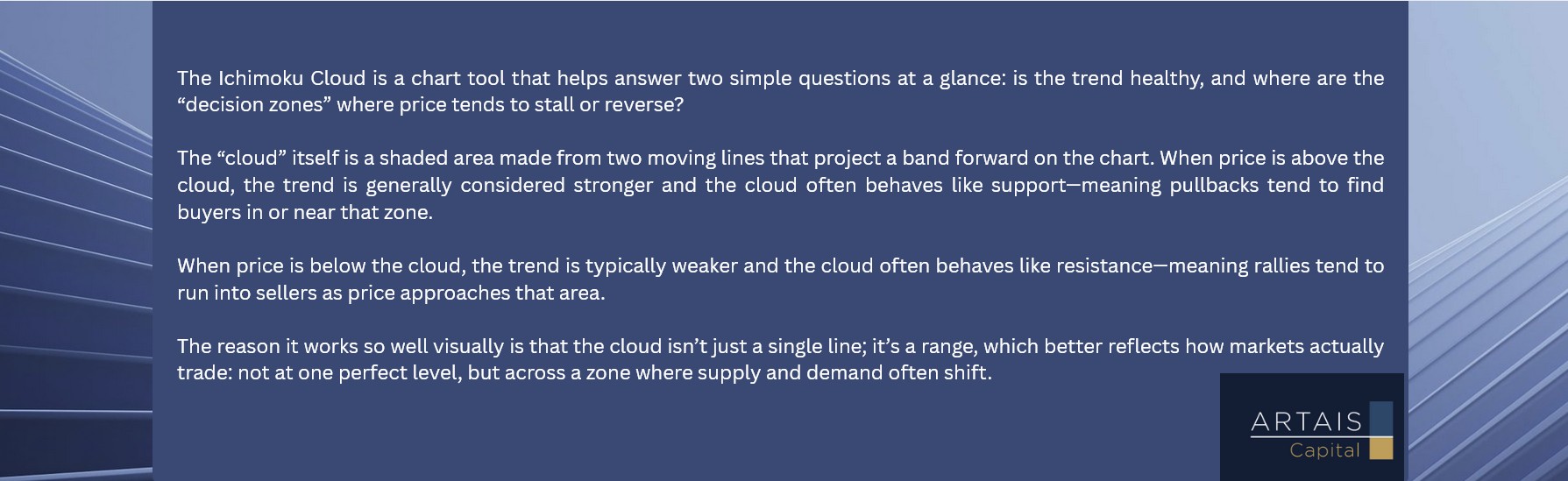

Second, and more importantly, the ETF is struggling with the cloud model (a.k.a. the Ichimoku Cloud). The Ichimoku cloud tends to act as support and resistance and can give us a nice visual of the current trend.

The tech-heavy QQQ has a similar pattern:

Why does this even matter?

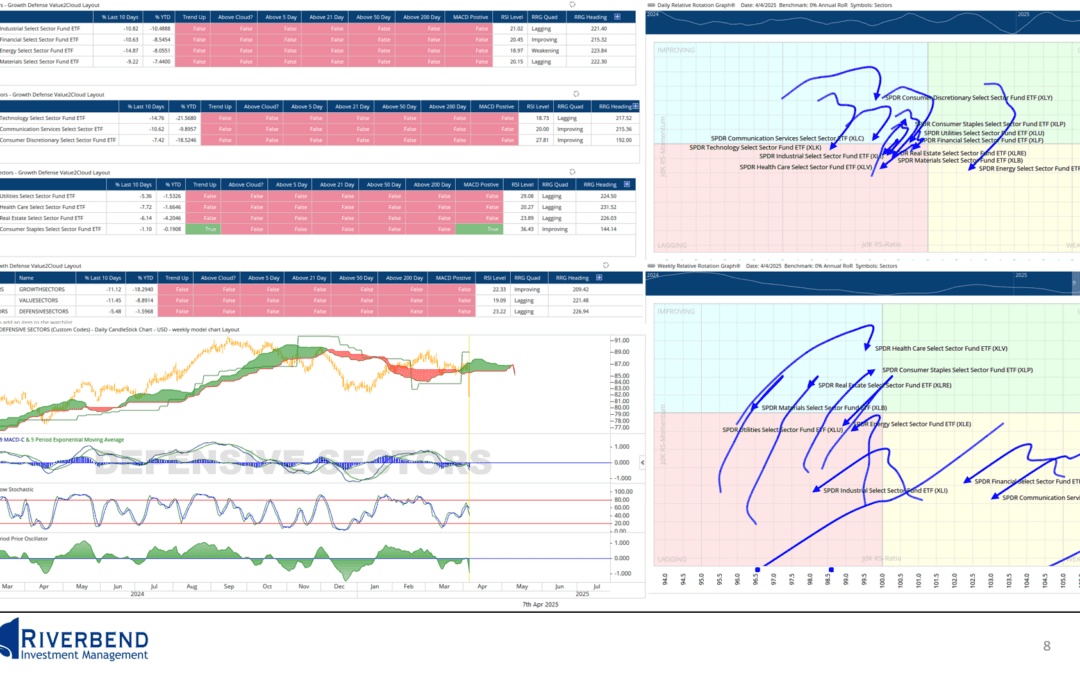

Currently, the largest sector weighting of the S&P 500 index is technology. For the index to move meaningfully higher, we will need technology to start leading the market again. Something it has not done since late October.

S&P 500 Sector Weighting as of July 31, 2025 | Created with Google Gemini

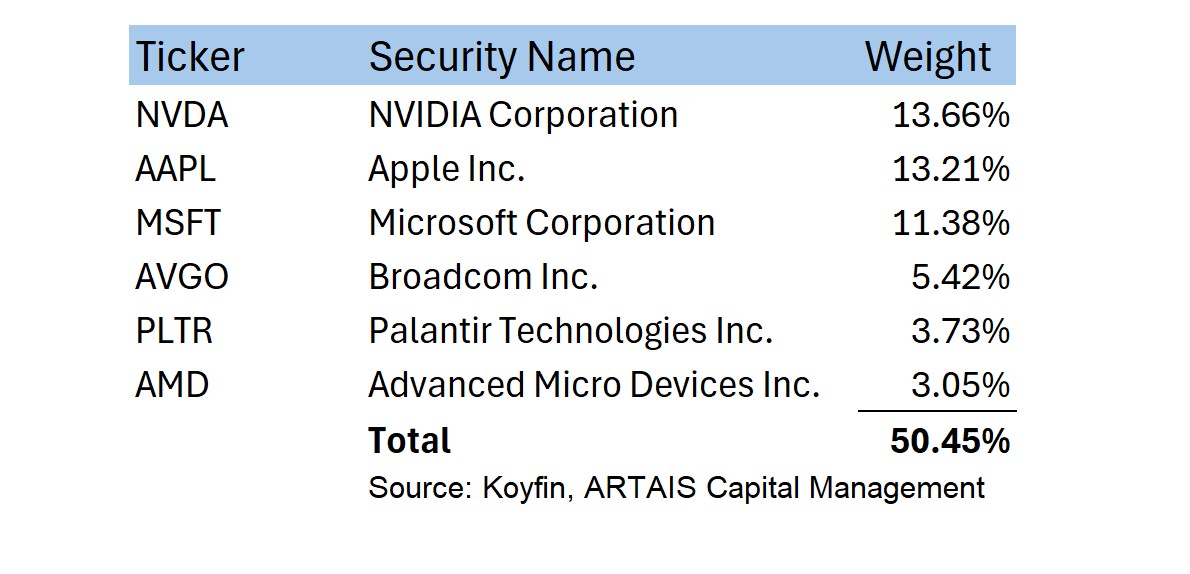

Within the technology sector, NVIDIA has the largest weighting, and the top six names make up a whopping 50% of the XLK ETF:

Status of Current Tech Leaders:

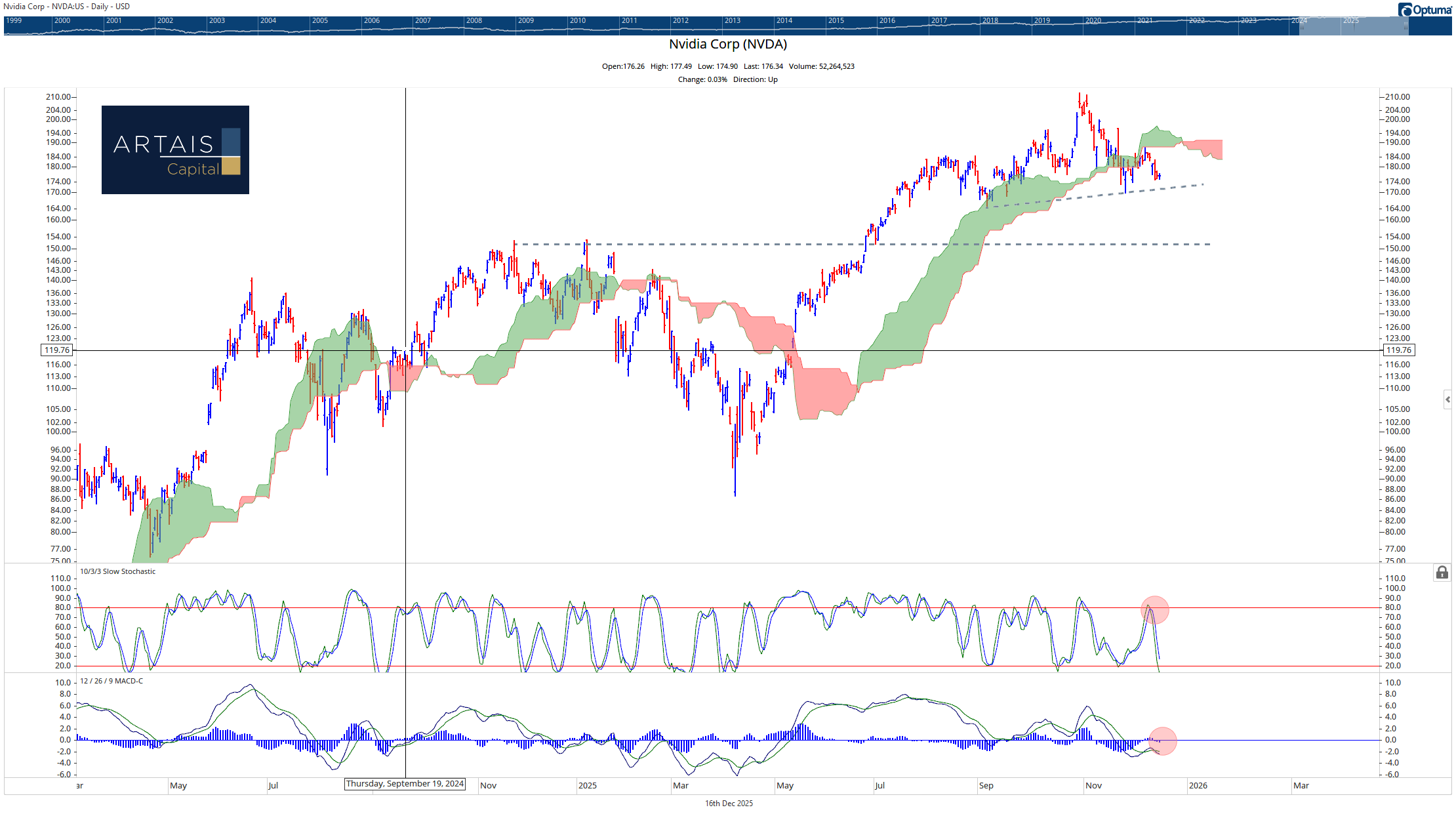

A similar pattern begins to emerge when we take a closer look under the hood of the tech sector. Four of the top five names are struggling with overhead cloud resistance:

NVIDIA (NVDA)

Microsoft (MSFT)

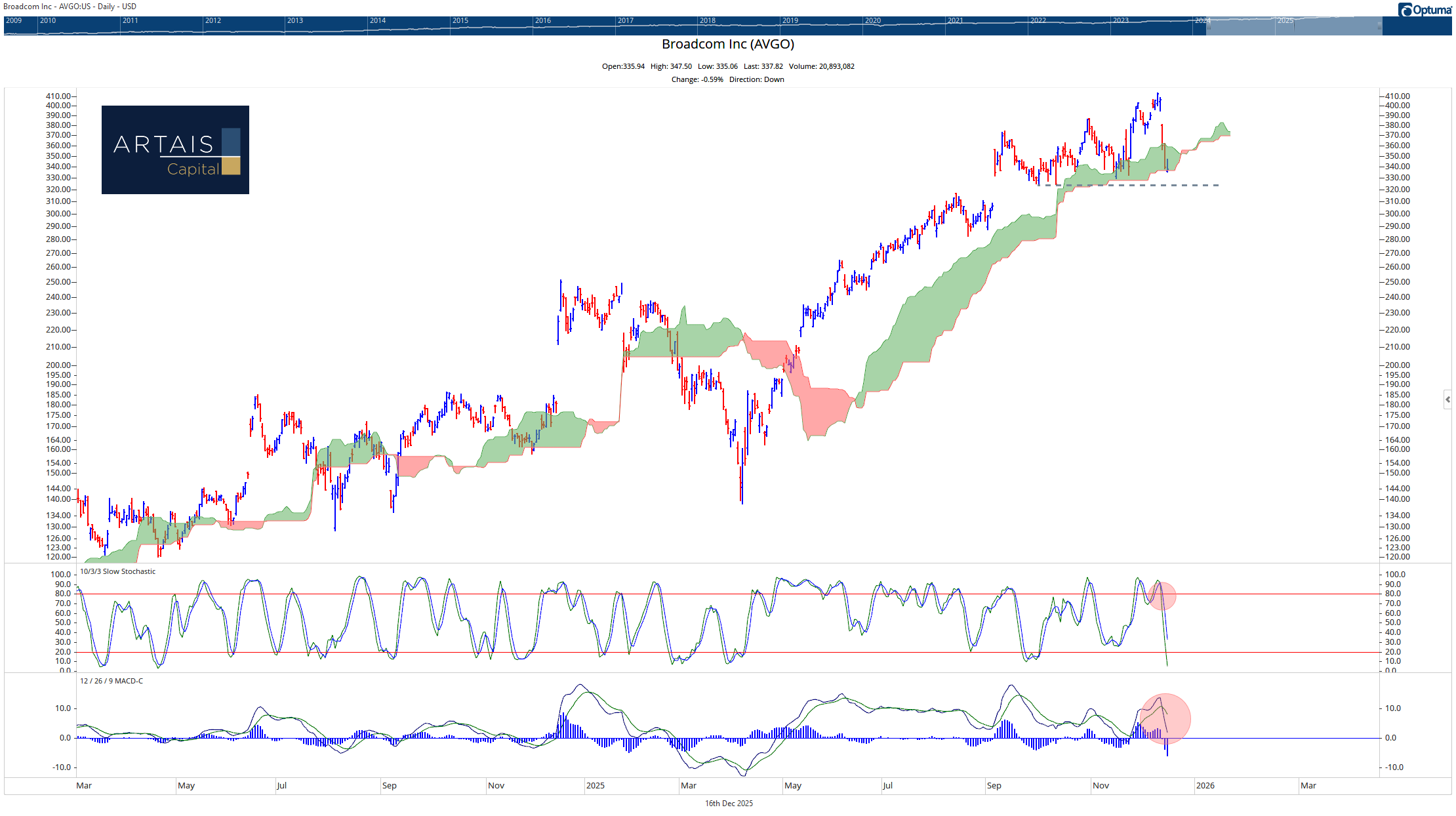

Broadcom (AVGO):

Palantir Technologies (PLTR):

Advanced Micro Devices (AMD):

Is Christmas Canceled? (and What I am Keeping an Eye On)

Not necessarily, especially if you are a non-index investor.

Tactical investors, like myself, have been taking advantage of non-tech sectors.

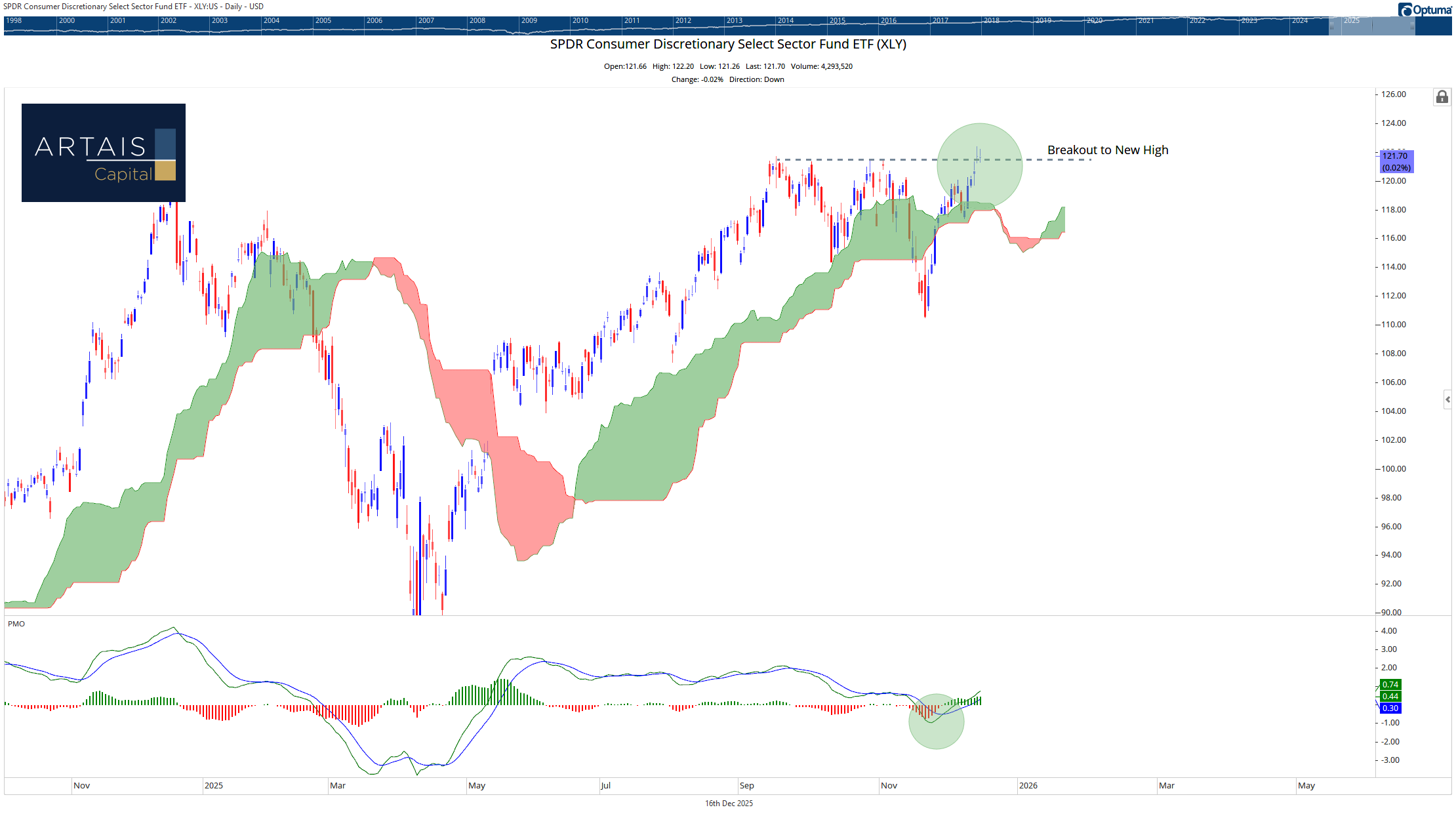

Consumer Discretionary stocks (XLY) are breaking out to new highs:

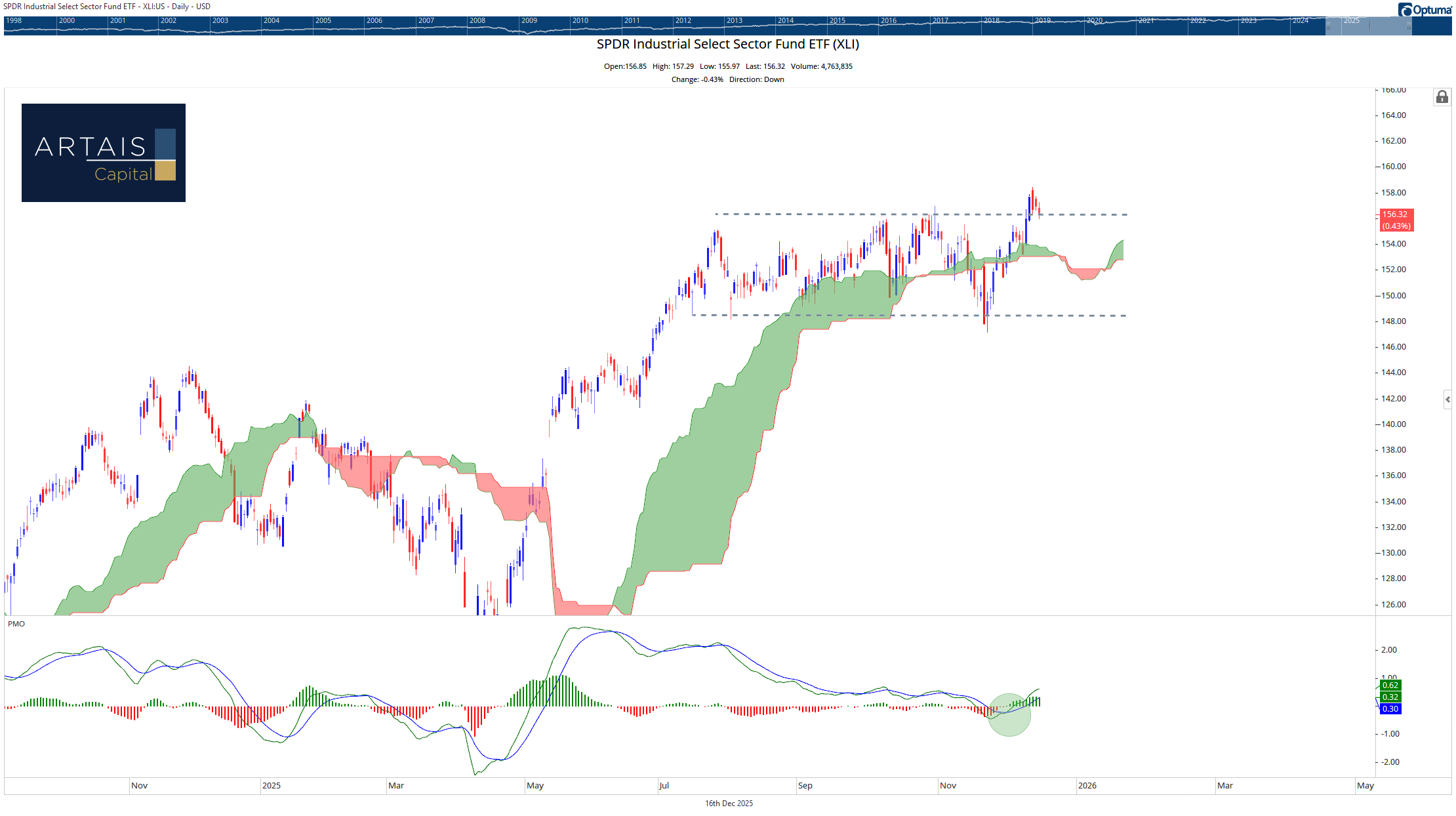

Industrials (XLI) are similarly testing new highs, after a multi-month sideways trading pattern (potentially setting up the start of a new upward trend):

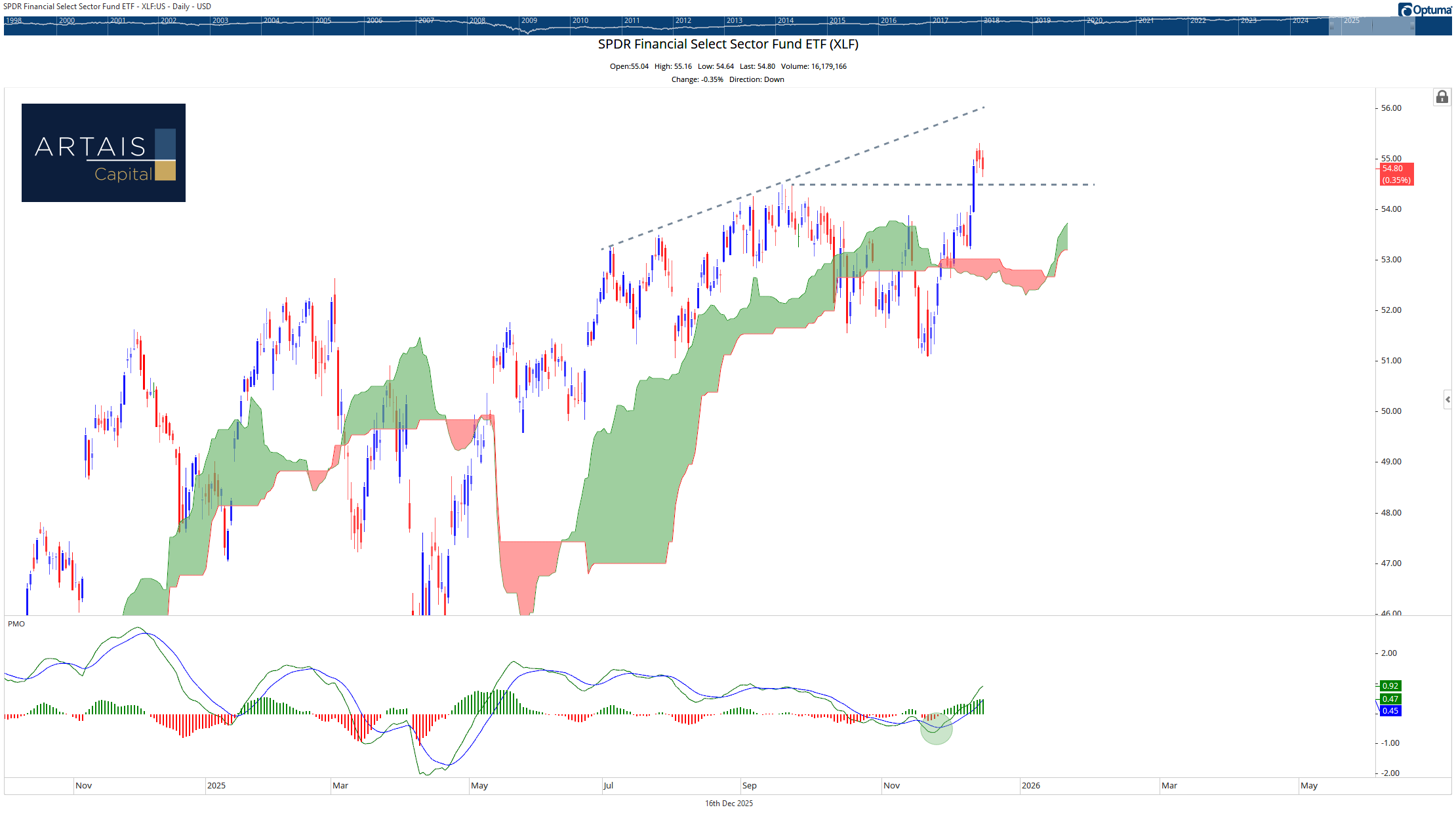

Financials (XLF) have broken out to new highs, as well:

…and, within each of these sectors, numerous opportunities are present.

So, is Christmas canceled? Not at all — but it may not look like the typical “index melt-up” investors have become conditioned to expect.

The bigger takeaway is this: when technology is acting as a headwind, the S&P 500 can feel frustratingly stagnant even while opportunities are showing up elsewhere.

That’s why the focus remains on what price is actually doing — whether tech can reclaim leadership and clear key resistance, and whether the sectors currently carrying the market can continue to follow through.

This is exactly the type of environment where a tactical approach can add value: staying flexible, leaning into what’s working, and respecting risk when leadership is missing.

As always, the goal isn’t to predict the next headline — it’s to stay aligned with the trend and avoid getting trapped when market conditions change.