Investment Research from John Rothe, CMT

Is Gold a Good Hedge Against Inflation?

Is Gold a Good Hedge Against Inflation? Gold has historically been viewed as a reliable store of value and a hedge against inflation. Throughout time, investors have turned to gold during economic upheavals, political unrest, and times of inflation. But how accurate is this belief? Is gold genuinely a good inflation hedge?

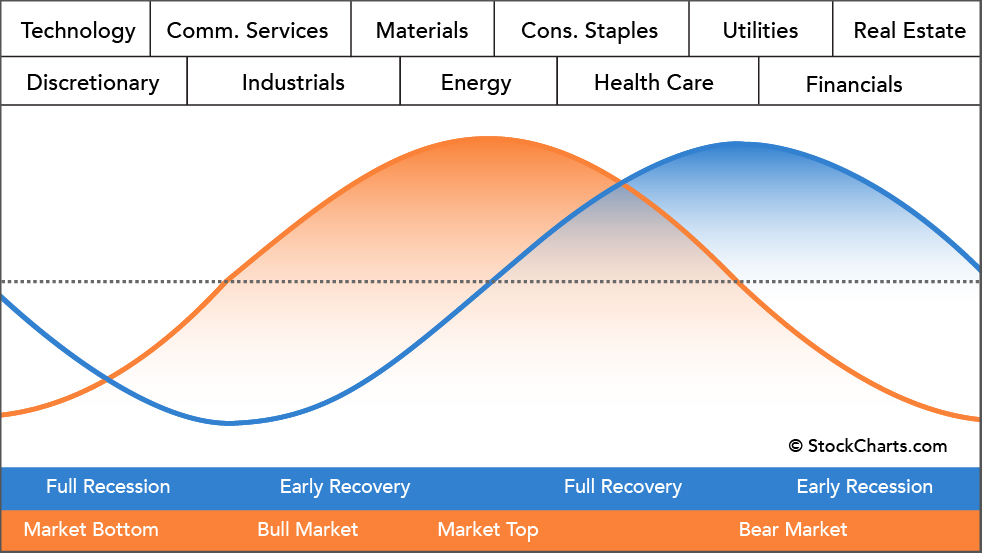

The Alpha in Sector Rotation: A Research-Driven Approach

Examination of various types of sector rotation strategies, from economic cycle-based to event-driven. Detailed analysis of academic research, providing evidence-based insights into the effectiveness of sector rotation.

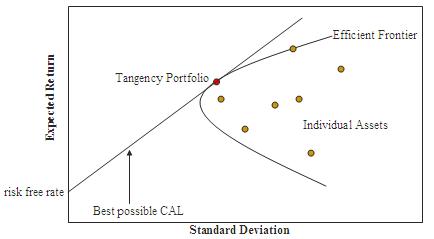

The Problem with Modern Portfolio Theory

The Problem with Modern Portfolio Theory: The world of finance is replete with theories and models. Yet, few concepts have left as indelible a mark as Modern Portfolio Theory (MPT). Proposed by Harry Markowitz in his 1952 paper, “Portfolio Selection,” MPT has been both a guiding light and a point of contention among investors for decades.

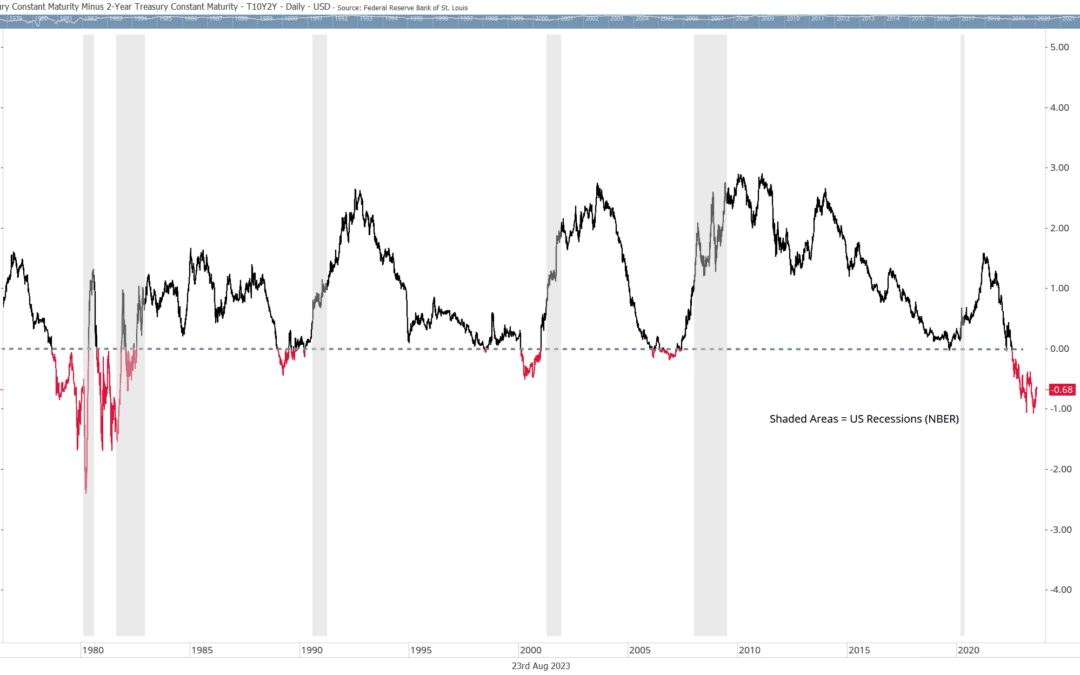

The 10-Year vs. 2-Year Treasury Bond Spread: Implications for the Economy and the U.S. Stock Market

The 10-Year vs. 2-Year Treasury Bond Spread, known as the “10-2 spread”, has emerged as a focal point for policymakers, investors, and market watchers. But what makes this spread so significant? Can it really be a trusted herald of impending recessions?

Understanding Fibonacci Retracement Levels

If you’re looking to unlock valuable insights into market trends and make more informed trading decisions, then understanding Fibonacci retracement levels is essential. Originating from the genius mind of Leonardo of Pisa, these levels hold a special place in the world of technical analysis.

Small Businesses Owners Still Facing Challenges

Small Businesses Owners are Still Facing Challenges. As per the Small Business Administration, there are over 30 million small businesses in the United States, representing approximately 99% of all U.S. businesses. Notably, small businesses employ around 48% of the American workforce, which translates to almost 60 million employees. Undeniably, small businesses play a significant role in our economy.

Highlighting recent developments, the NFIB’s Small Business Optimism Index saw a promising increase of 1.6 points in June, reaching a score of 91.0. It is worth noting that this marks the 18th consecutive month below the 49-year average of 98, indicative of room for improvement. When it comes to key concerns, small business owners are primarily troubled by both inflation and labor quality, with 24% reporting each as their primary problem. Fortunately, there has been a slight decline in the net percent of owners raising average selling prices, currently at a seasonally adjusted rate of 29%. Although still high, this figure reflects a downward trend, offering a glimmer of relief for small business owners. It is vital to mention that this reading is the lowest since March 2021.

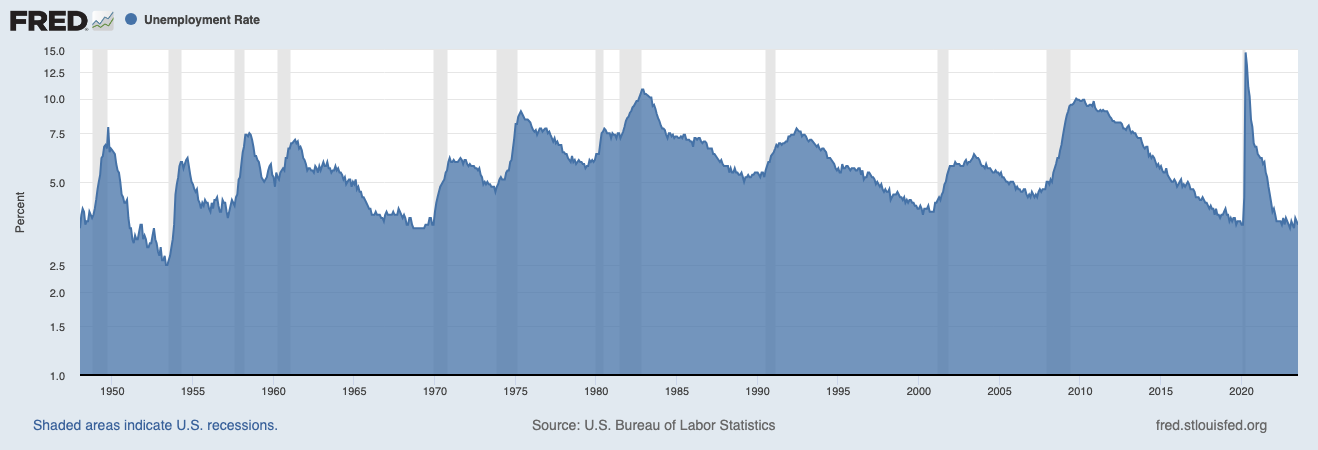

Job Growth in the US Slows to a More Sustainable Pace

The latest job report shows a notable slowdown in U.S. job growth, with employers adding 187,000 jobs in July, slightly below economists’ forecast of 200,000 positions. However, there’s no need to worry as this indicates a shift towards a more sustainable pace, which still exceeds the pre-pandemic monthly average. Additionally, the July figure is slightly higher than June’s revised payroll gain of 185,000. In this article, we’ll explore what this means for the economy and the implications for investment decisions.

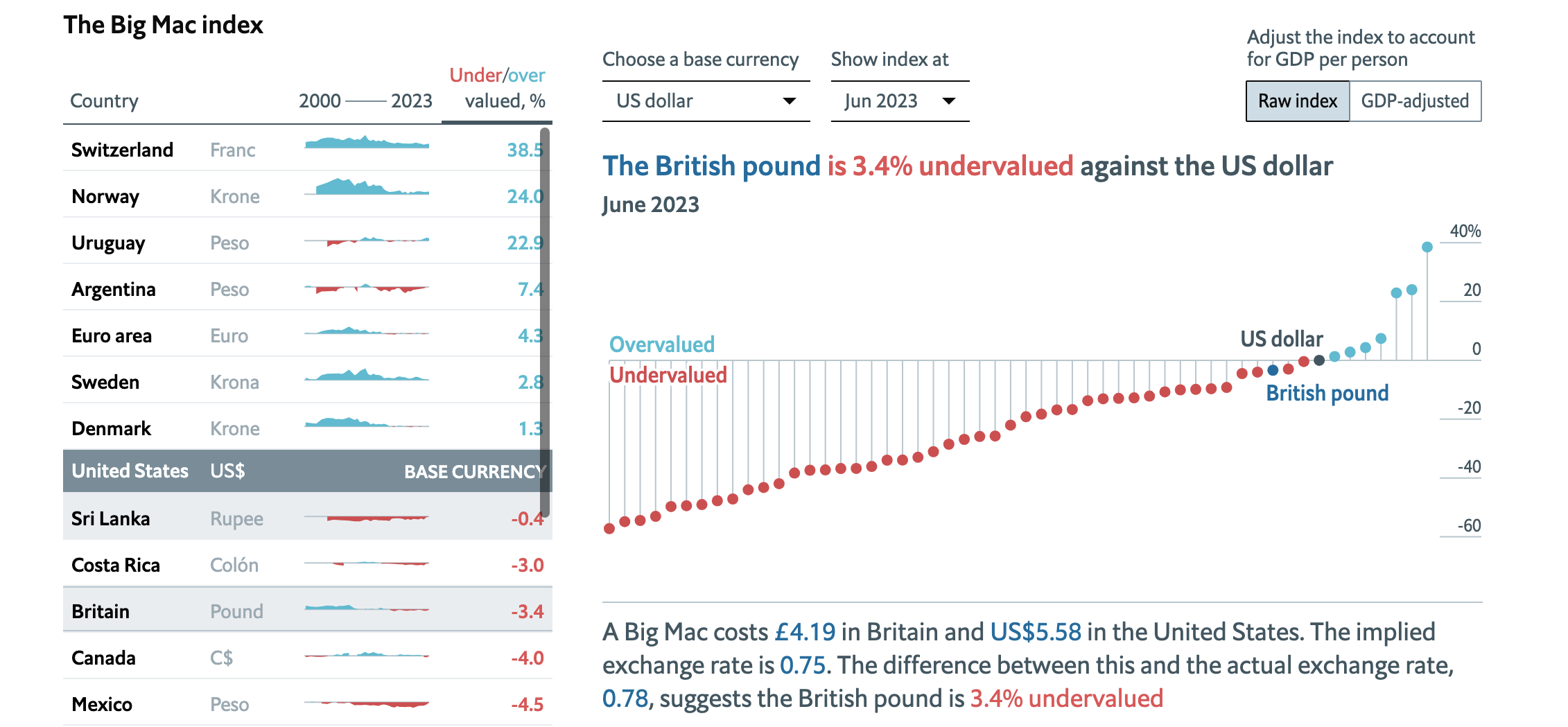

The Big Mac Index: Exploring Currency Valuation and Inflation

The Big Mac Index is an intriguing economic indicator that offers a unique perspective on the world’s currencies and purchasing power parity (PPP). Created by The Economist in 1986, it has since gained significant recognition as a tool for illustrating currency value comparisons.

Value at Risk (VaR): Uses and Controversies

Value at Risk (VaR) is a powerful tool in modern risk management. As a statistic, VaR accurately predicts the maximum potential losses within a defined time frame. This invaluable metric is widely embraced by financial institutions and commercial banks for investment analysis. With VaR, one can gauge the magnitude and probabilities of potential portfolio losses effectively. Risk managers rely on VaR to measure and maintain optimal risk exposure levels.

Navigating Different Types Of Momentum Indicators

Understanding the different types of momentum indicators, such as the MACD, RSI, Stochastics and On-Balance Volume (OBV), can help investors increase their trading success rate. This article examines the various indicators and provides examples.